In order to understand the current state and trends regarding insurance payments, Celent conducted an online survey with insurers and managing general agents (MGAs). The results indicate that insurers recognize their payments capabilities as a differentiation opportunity and give their strategies careful attention. However, continued adjustments are necessary because not all insurers appear to be transitioning their views of payments from a tactical perspective to a strategic one.

Celent has released a new report titled Insurance Premium Payments: Back End or Front End Opportunity? The report was written by Michael Fitzgerald, a Senior Analyst with Celent's Insurance practice.

In order to understand the current state and trends regarding insurance payments, Celent conducted an online survey with insurers and managing general agents (MGAs). The results indicate that insurers recognize their payments capabilities as a differentiation opportunity and give their strategies careful attention. However, continued adjustments are necessary because not all insurers appear to be transitioning their views of payments from a tactical perspective to a strategic one.

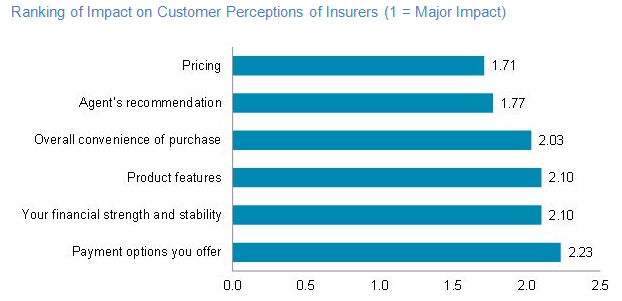

Survey participants rank convenience as a significant determinant of consumer choice. Ease of payments is an important component of convenience. Over 43% view payments as a customer experience function; another 31% consider it a customer service function, highlighting payments as an important part of customer satisfaction. Slightly more than 40% of insurance payments are via paper check, and 21% are through manual ACH/EFT. Insurance payment methods are still evolving in a digital world.

“Celent advises carriers to take a fresh look at their payments capabilities, paying particular attention to factors such as customer and agent convenience, TCO, and process optimization that may have been stalled past efforts,” Fitzgerald commented.

“Unit costs are important, particularly for larger carriers that process high volumes of payments. But unit costs do not tell the whole story, and focusing on them may obscure the fact that powerful drivers of customer and agent behavior are not being leveraged,” he added.