The insurance industry is undergoing a significant transformation driven by digital and emerging technologies. Insurers are embracing innovative solutions to meet evolving customer expectations and stay competitive in a rapidly changing landscape. Digital channels now play a crucial role in delivering personalized and consistent experiences, and advancements in artificial intelligence (AI) technology, such as natural language processing (NLP) and Large Language Models (LLMs), have opened up new possibilities for insurers.

The Peppercorn Insurance case study highlights the successful implementation of the specialist insurance conversational AI platform, Pipr, developed by Peppercorn AI. The Pipr platform relies on artificial intelligence technology, including insurance-trained natural language processing and native large language models. This initiative aims to digitally transform the insurance operating model and provide customers with a more personalized, on-demand digital conversational experience that puts them in control throughout their insurance journey while interacting with Peppercorn Insurance, an MGA launched by Peppercorn AI.

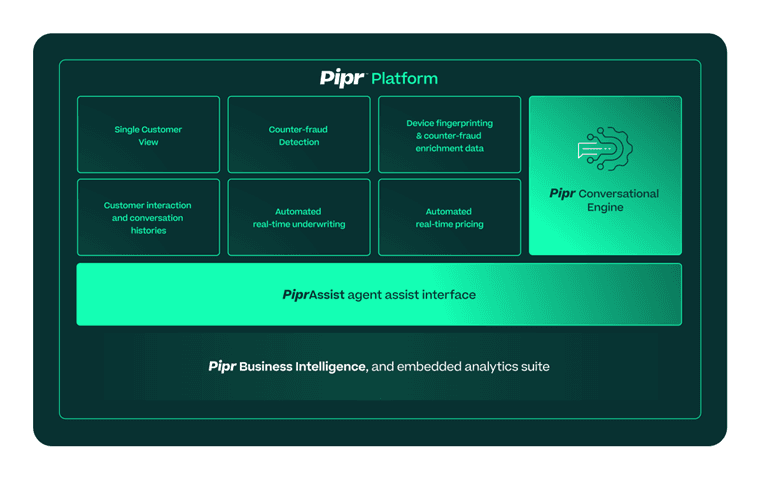

Pipr Platform:

The Peppercorn insurance case study offers a compelling glimpse into the dynamic landscape of the insurance industry, where digital innovation driven by artificial intelligence technology is reshaping traditional operating models.