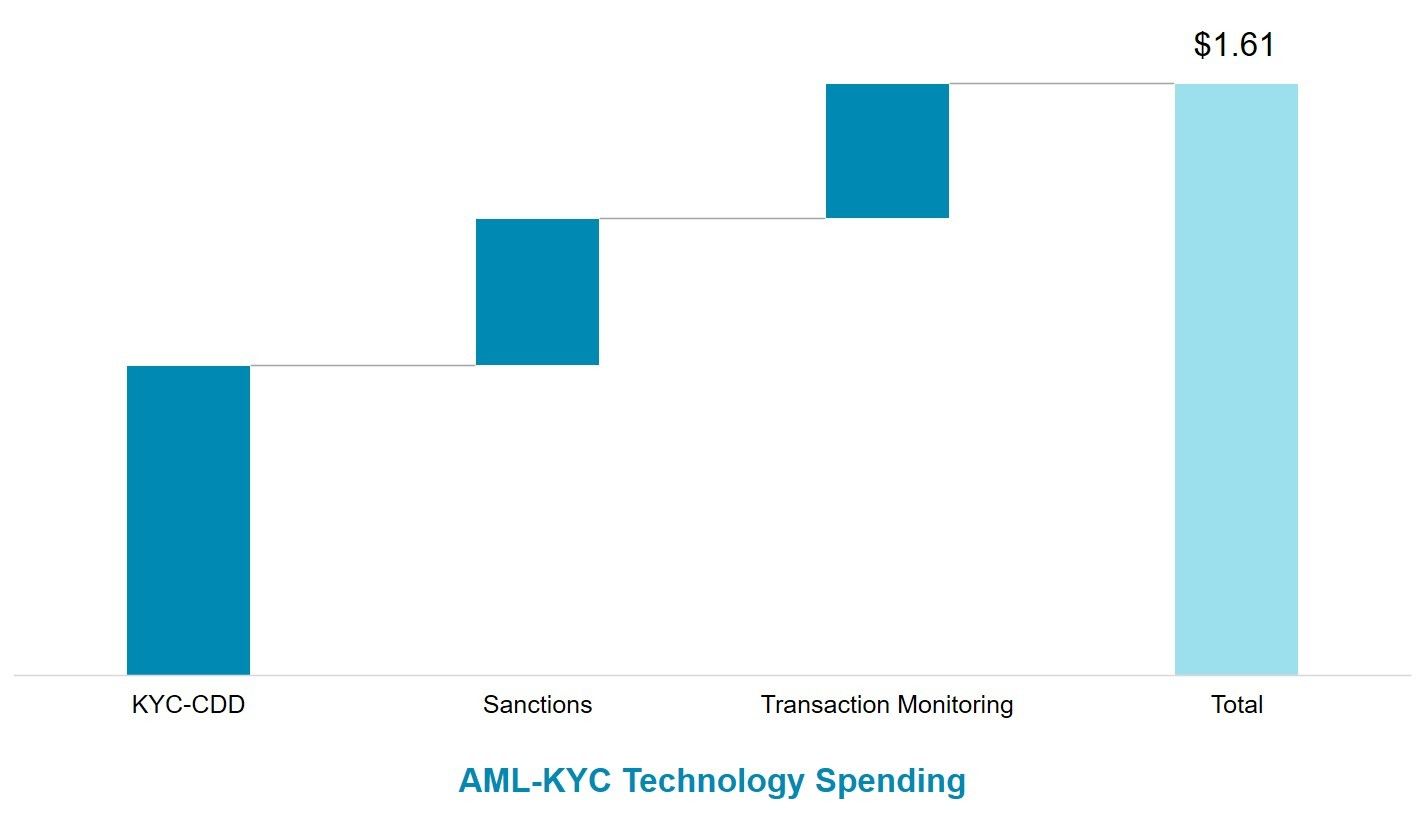

As Asian countries seek to compete globally and assert their influence on the world stage, their regulators and political authorities are having to ramp up their Know Your Customer (KYC) and Anti-money Laundering (AML) regulations and supervisory frameworks to assure foreign investors, banks, and governments about the safety and stability of their domestic systems. As a result, the AML regimes in almost all Asian countries are being strengthened which is driving spending on AML technology and operations by Asian financial institutions. Celent estimates that spending on technology in AML-KYC compliance by Asian financial institutions will reach US$1.6 billion in 2019 accounting for 19% of global spending; spending on operations will reach US$4.0 billion in 2019.

The future of Asian AML operations will be driven by the regulatory agenda of aligning the numerous national frameworks with the internationally prevailing ones while catering to country specific requirements. The developed Asian countries will play the leading role in these efforts, and the emerging economies are likely to quickly catch up.

KYC-CDD Is The Biggest Driver of Technology Spending

Source: Celent. Figures in US$ billions.

This report provides Celent’s estimates of spending on AML-KYC technology and operations by Asian financial institutions, including banks, insurance companies, broker-dealers, and wealth and asset management firms. The report presents Asian spending estimates as well as detailed breakdowns of:

- Spending by global region: North America, Europe, Asia, and the rest of the world.

- Functional distribution of Asian spending with focus on three key AML-KYC components: KYC-CDD, sanctions screening, and transaction monitoring.

- Asian technology spending breakdown by: internal spending, hardware, external software, and external services.

- Asian operational spending trends (in addition to technology spending).

- Asian spending according to the type and size of financial institution.

- Asian spending on new initiatives vs. run-the-bank maintenance activities.

- Historical spending growth trends in Asia and estimates for future growth.

This is the third in a series of Celent reports analyzing spending trends in AML-KYC.