Five observations and a final takeaway from my latest report, Private Capital on the Rise: The UHNW, Private Securities, and the Hunt for Non-Correlated Assets.

Five observations and a final takeaway from my latest report, Private Capital on the Rise: The UHNW, Private Securities, and the Hunt for Non-Correlated Assets.

- The digital revolution, the requirements of a behaviorally distinct Millennial generation of investors, and the bloating of the IPO market post crisis have driven enthusiasm for non-bank or alternative sources of capital, with private equity (and venture capital) funds at the fore.

- Recently, direct investment (i.e. the deployment of private capital into closely held companies) has emerged as an intriguing alternative to private equity, particularly among family offices.

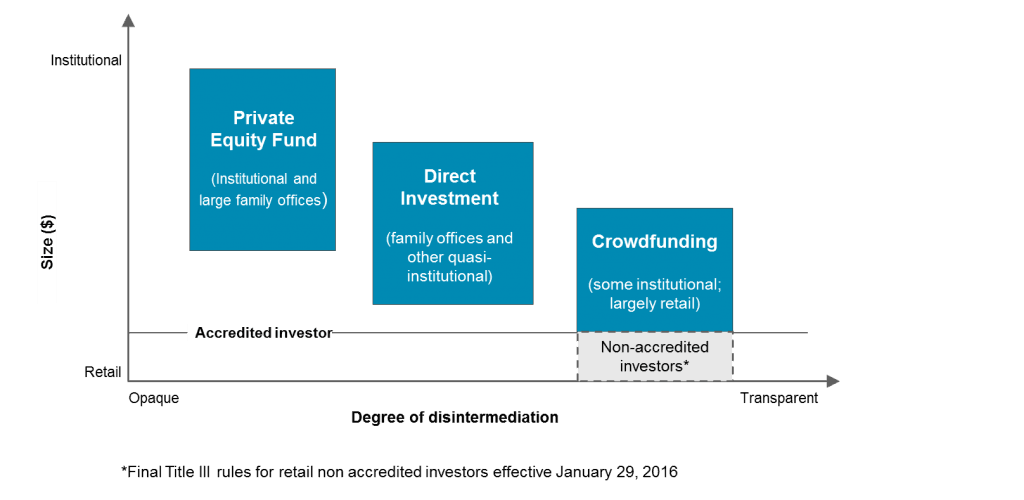

- As per the figure above, direct investment represents the “fat middle” of the traditional funding hierarchy. It assumes the disintermediation of the private equity fund manager, and is more discreet and flexible than equity crowdfunding, which has a distinctly retail orientation.

- On the down side, accounting system limitations make it difficult to value and account for private holdings in any scalable way. The inability to capture pricing and position information on a regular basis presents risks and opportunity costs for the direct investor.

- The good news is that technology vendors are developing systems to track and reflect percentages, cash outlays, and other categories relevant to private capital investment, as opposed to systems that view the world solely through the lens of unitary shares.