バイサイドへの圧力が強まっている。オペレーション要件と規制要件をコスト効率に優れた方法で管理するために、投資運用会社は既にバックオフィスとミドルオフィスの多くの機能をアウトソーシングしているが、一部の運用会社では、かつては聖域とされていたフロントオフィスの機能さえもアウトソーシングする動きがある。本レポートでは、こうしたアウトソーシングモデルへの移行にあたり、バイサイドへのテクノロジーおよびサービス提供の傾向とそれによる影響について考察する。更に、この移行が進む論理的根拠、需要ドライバー、変化するプロバイダー業界について検証する。セレントは、データおよび指標となる見解を収集するために、トレーディング機能のアウトソーシングを検討あるいは既に実施している複数のグローバルなアセットマネージャーとヘッジファンドから話を聞いた。その結果、大半が様々な資産クラスに投資していたものの、株式への配分が高かった。また、この業界で活動しているアウトソーシングプロバイダー、プライムブローカー、テクノロジープロバイダーからも話を聞いた。

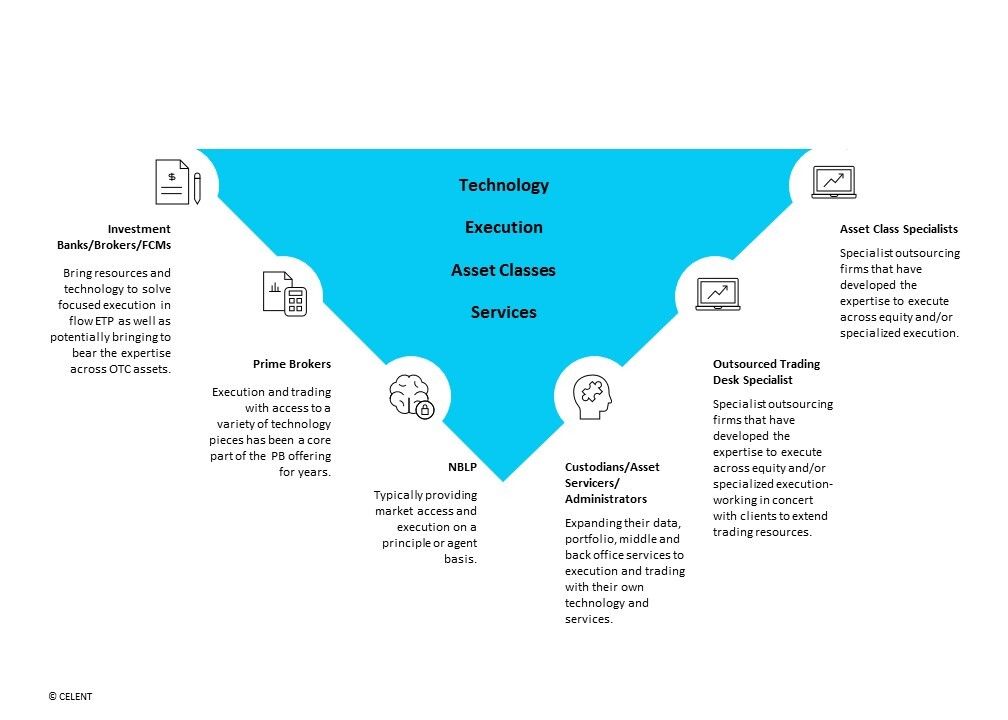

アウトソーシングパートナーの選択肢