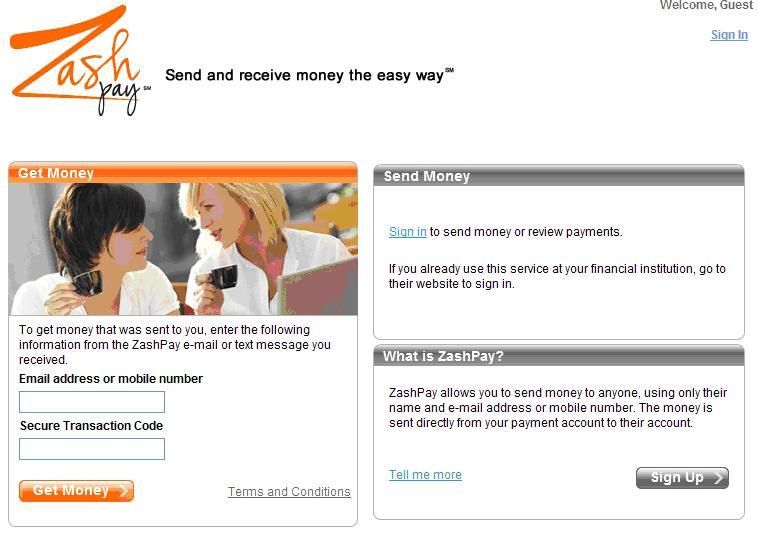

While attending Fiserv Analyst Day 2010 on Thursday last week, I unwarily volunteered to participate in a live demo as part of a presentation of Fiserv’s digital channels solutions. This was a bit risky since at the time, I had been an iPhone user all of twelve hours. Fiserv launched ZashPay in July 2010 and has commitments from over 400 FIs. It’s off to a very good start. After announcing my name and cell number to the entire crowd, I received a text message from ZashPay in seconds indicating “Steve Olson sent $25.00” and included a unique transaction identification number. Steve is Group President of Fiserv’s Digital Payments Group and was assisting with the demo. Taking all of about 10 seconds to receive the text, the demo seemed successful enough and for $25.00 it was an equitable transaction considering my risk of embarrassment. Then, I began thinking about how clearing and settlement would occur. The following day (Friday) I reviewed the message and visited the ZashPay website to see about making Steve good for his $25.00 promise. The website was simple and intuitive, with an obvious invitation to enter a unique transaction code provided within the SMS in order to receive payment.  As expected, I was required to enroll in ZashPay in order to process the payment, since my primary depository financial institution does not offer the product. It took a strong stomach to enter such sensitive information as my social security number, birth date and address all in one place. This would likely dissuade some consumers from using ZashPay apart from being offered by their financial institution. Steve’s payment was credited to my DDA two business days later. Since I took action on a Friday, payment was not received until the following Tuesday. As a receiver of ZashPay payments, the experience was straightforward and did not carry a fee. I appreciated the immediacy of the SMS notification compared to PayPal which notifies using e-mail. If my primary financial institution offered it as part of its mobile banking suite, I’d be a regular user since I carry little cash and leave my check book at home. But sending carries a fee – 75 cents per transaction goes to ZashPay, plus whatever the ODFI charges for the ACH transaction. So, maybe I’ll keep sending money using PayPal.

As expected, I was required to enroll in ZashPay in order to process the payment, since my primary depository financial institution does not offer the product. It took a strong stomach to enter such sensitive information as my social security number, birth date and address all in one place. This would likely dissuade some consumers from using ZashPay apart from being offered by their financial institution. Steve’s payment was credited to my DDA two business days later. Since I took action on a Friday, payment was not received until the following Tuesday. As a receiver of ZashPay payments, the experience was straightforward and did not carry a fee. I appreciated the immediacy of the SMS notification compared to PayPal which notifies using e-mail. If my primary financial institution offered it as part of its mobile banking suite, I’d be a regular user since I carry little cash and leave my check book at home. But sending carries a fee – 75 cents per transaction goes to ZashPay, plus whatever the ODFI charges for the ACH transaction. So, maybe I’ll keep sending money using PayPal.