団体/任意保険は、既存の保険会社だけでなく、多くは5年前には存在していなかったような新規参入企業からも関心が寄せられている活発な市場である。団体/任意保険事業を手掛ける保険会社は、新たなエコシステムを取り入れ、パートナーと共にイノベーションに取り組み、さらにポータビリティを促進するオープンかつ柔軟な新機能に投資するという選択をすることで、変化する状況を利用して優位に立つことができる。

保険会社は、変化する従業員給付の状況をうまく利用できる立場にある。以下は、そのために必要な対応をまとめたものである。

- 従業員とのエンゲージメントを高めることで、有益な提案と、従業員の状況を把握することができる摩擦のないデジタルエクスペリエンスを創出する。

- 多様な対応を通じて関係性を強化することで、従来の補償範囲を超えて、従業員の総合的なニーズを満たすより包括的なウエルスサービス、ヘルスケアサービス、および保障サービスを提供する。

- 持続性を高めることで、転職する際も給付を維持したいと考える従業員に対し、期待通りのポータビリティと極めて現実的な可能性を提供する。

- 新興のスタートアップが推進する保険販売サービスとパートナーサービスを包含する新たなパートナーシップを通じて、サービスの提供範囲を拡大する。

- 総合的なバリュープロポジション以上のものを持つか、あるいは他のエコシステムにおいてスペシャリストになることで、ポジションを確保する。

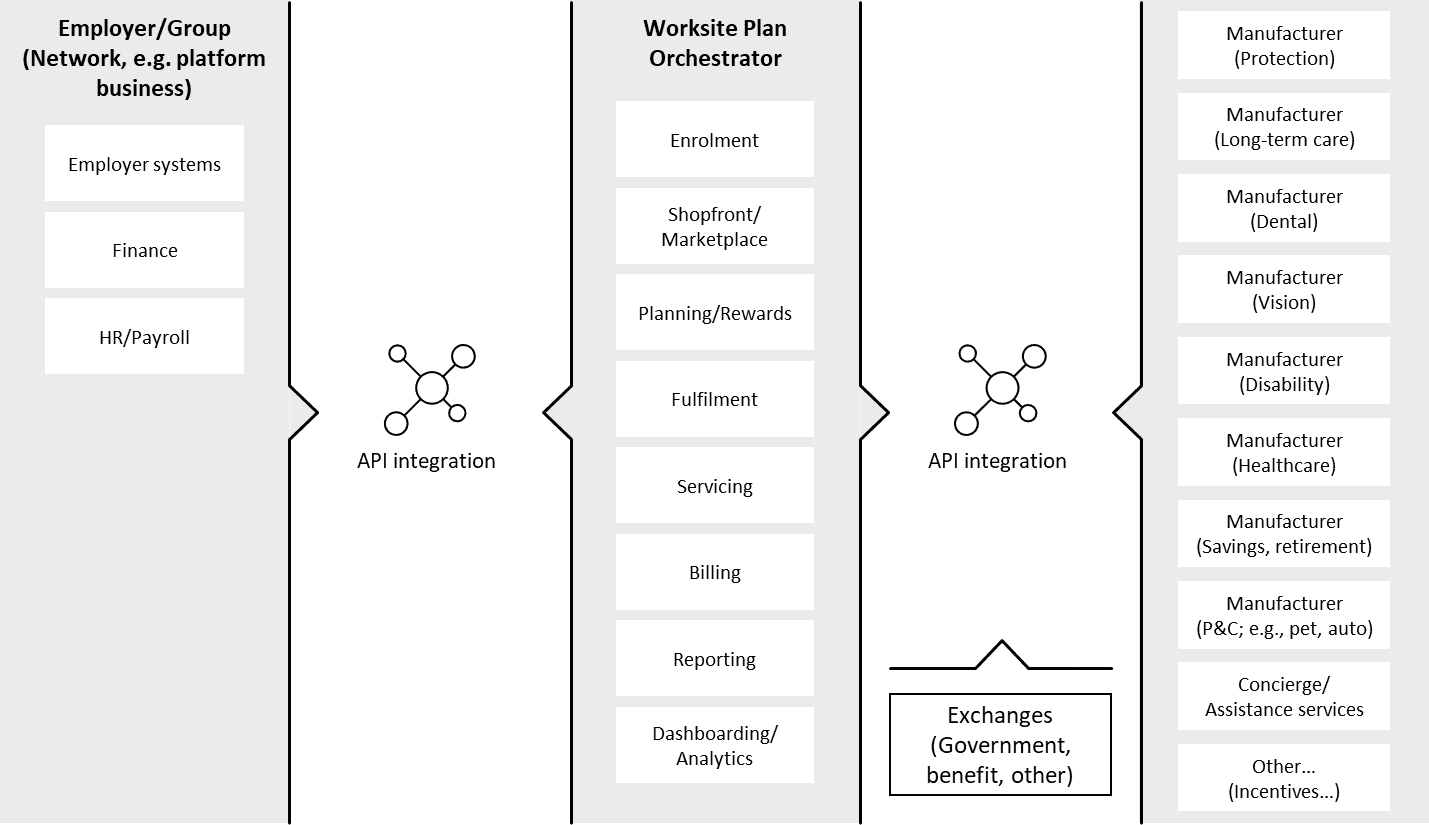

- 人材とテクノロジーに投資し、オープンでAPI中心の次世代型プラットフォームを採用することで、開放性を備えた機能に投資する。

図:一般的な従業員給付エコシステム

テクノロジーは、これらを実現するための重要な基盤である。現在は、次のような次世代プラットフォームの波が起こりつつある。

- 柔軟なテクノロジーによるオープン・バイ・デザイン (仕様段階からオープンにする)で、オープンなAPIがDNAの一部を形成して共創が可能になるほか、ローコードの手法でコンフィギュレーションが達成される。

- 従来のバックエンドを管理する一方で、フロントで楽しく摩擦のないユーザー体験を提供しながら、新しい提案を迅速に行うことで、ミドルへと移動する。

- 興味深い新たな方法でデータを活用し、雇用者主導のプロセスと従業員主導のプロセスに分析面で改善を加えると同時に、クラウドの力を利用して根本的に異なるプライス・ポイントで大規模にAIを動作させる。

本レポートでは、機会、パートナーシップの新たな展望、必要なテクノロジー機能について検証する。