Policy administration systems are effective at generating policies by capturing demographic information, tracking policy terms and conditions, and calculating rates. However, they often fall short in assisting underwriters with their tasks. Underwriters need to analyze prior losses, financial conditions, exposures, and controls, as well as determine reinsurance needs and assess data. These tasks are typically performed outside of the policy administration system, leading to delays and potential errors.

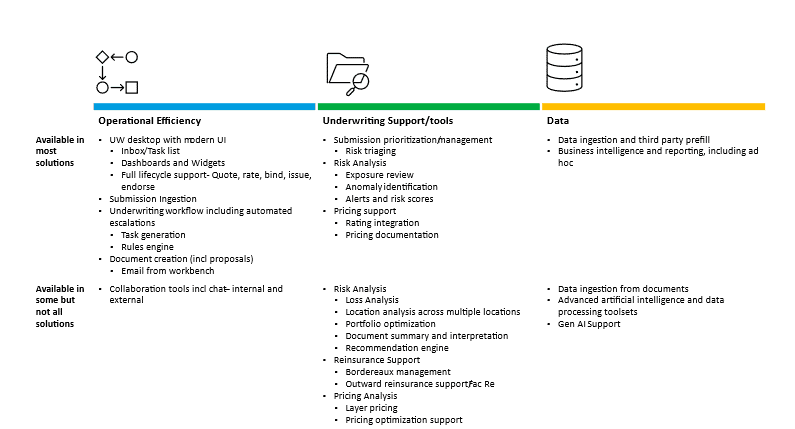

Insurers are increasingly interested in underwriting workbenches to address these challenges. These workbenches provide better decision tools, improve operational efficiency, and support underwriting tasks that are not typically supported by core systems. They offer a range of capabilities focused on efficiencies and decision-making. Insurers are turning to these workbenches to address margin pressure, market conditions, data demands, competition, and platform consolidation.

But these products are still relatively new and have not landed on a ‘standardized’ definition of what they are. In this report, we define what an underwriting workbench is, including a glossary of features, and identify some of the variations that are available in the marketplace. Additionally, we provide profiles of 15 workbenches, offering an overview of their functionality, customer base, and technology.

Features of an Underwriting Workbench