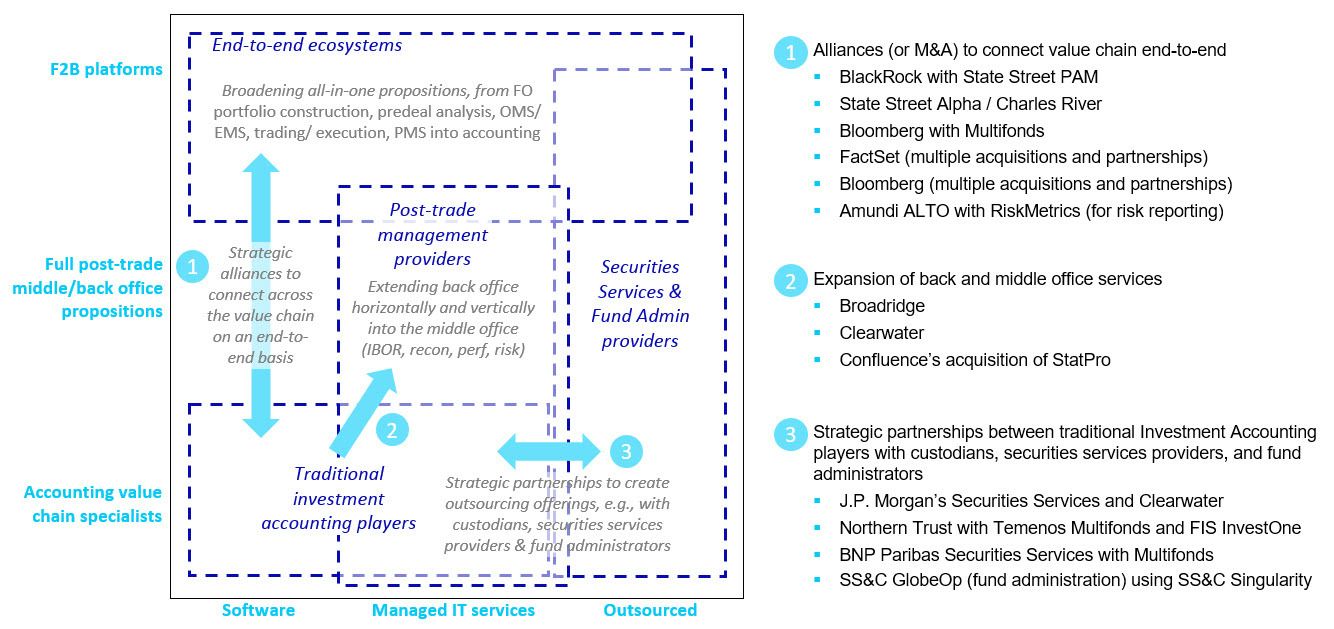

Shifting end-user demands toward fewer strategic vendor relationships are pressuring vendors to connect more broadly with other providers. Throughout the value chain, we observe service providers form/extend partnerships in order to prepackage and prebundle their offerings in conjunction with others (e.g., for esoteric asset pricing models, conventional and alternative datasets, news/sentiment, and AI-powered analytics). Here, modularization enables the unbundling/rebundling of products/services. In addition, interoperability—for example, through microservices and open APIs—can help facilitate collaborative partnerships and continued digitization of the investment value chain by employing modularized offerings to create new propositions and innovations.

Within the investment management sector, examples are already evident: