On October 17, Celent hosted the Celent Innovation Forum in Tokyo. We will be posting a two-part recap that covers the key points of the event.

Keynote Presentation 1

The core message of this address was that the current ecosystem is changing and market players need to respond. The business environment is fueling change against a backdrop in which external pressures and factors such as consumer experience and expectations, economic deterioration or improvement, regulation and drastic changes to the competitive environment amplify existing pressures—such as pressures to grow revenue and cut costs. As such, players in the banking and financial industries need to modify their business models through changes in channels and architecture as well as innovation.

At the event, Celent introduced relevant cases from around the world addressing the below three themes in the context of digital and omnichannel frameworks and banking technology—two themes that Celent has consistently advocated.

- Digital and omnichannel

- Innovation and emerging technology

- Legacy and ecosystem migration

After touching on the latest technology trends, including Apple Pay and Bitcoin, the presentation addressed the importance of innovation in the context of Celent’s conceptual framework of creative destruction.

Fig 1 Digital and Omnichannel Framework

Source: Celent

Keynote Presentation 2

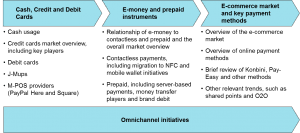

This presentation examined innovation initiatives in Japan’s financial services industry focusing on the below four retail payment areas.

- Traditional payment methods including cash, credit cards, and debit cards

- Second-generation payment methods such as electronic money and prepaid cards

- The most successful e-commerce payment services

- Omnichannel initiatives that cuts across the above three categories

What emerged as common to these four areas was that the key to success in innovation is the proliferation and use of digital technology, ecosystem creation, and the advancement of open innovation. In particular, the below five points were presented as areas that should we receive prompt attention.

- Card payment information multiview and control

- Value-added offerings that leverage card payment services

- Real-time transaction alerts

- Advisory services based on transaction data analytics

- Social media integration

Fig 2 Japan’s Financial Services Industry focusing on four Retail Payment Areas

Source: Celent