COVID-19 has taken an enormous human and economic toll on the world, and financial institutions globally are helping to implement government programs that have been designed to mitigate economic damage. In the United States, financial institutions have been rushing to implement the Paycheck Protection Program (PPP), a key provision within the Coronavirus Aid, Relief, and Economic Security (CARES Act), which provides fully guaranteed (and forgivable) loans to small businesses.

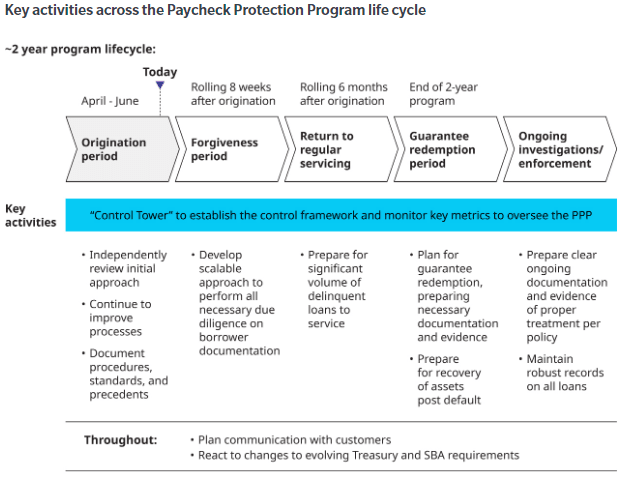

While the Paycheck Protection Program lending period expires June 30, 2020, and the funds may run out sooner, the pitfalls lenders face could lead to consequences for years to come. Oliver Wyman's paper, "Forgive But Don't Forget", offers immediate cross-functional recommendations while implementing thePaycheck Protection Program.

With the second tranche of Paycheck Protection Program funding approved by Congress, the time for lenders to act is now to improve processing, minimize additional risk, and change public perception. The focus must include both refinements to new loan origination and front-running potential issues in loan forgiveness, servicing, and ultimately guarantee redemption.