金融犯罪コンプライアンスは、金融サービスの中でおそらく最も厳格な効率性と正確性が求められる業務といえよう。幸いにも、新しいテクノロジーはそのサポート役を担うことができる。マシンラーニング、AI、自然言語処理に加え、最新の生成AIツールは、金融犯罪のより正確な発見と調査プロセスの効率化に役立つと考えられる。セレントは、コンプライアンスの成果を高める次世代テクノロジーへのニーズを背景に、金融機関はマネーロンダリング防止(AML)業務の効率性と正確性の向上に向けて戦略的投資をより加速させるとみている。

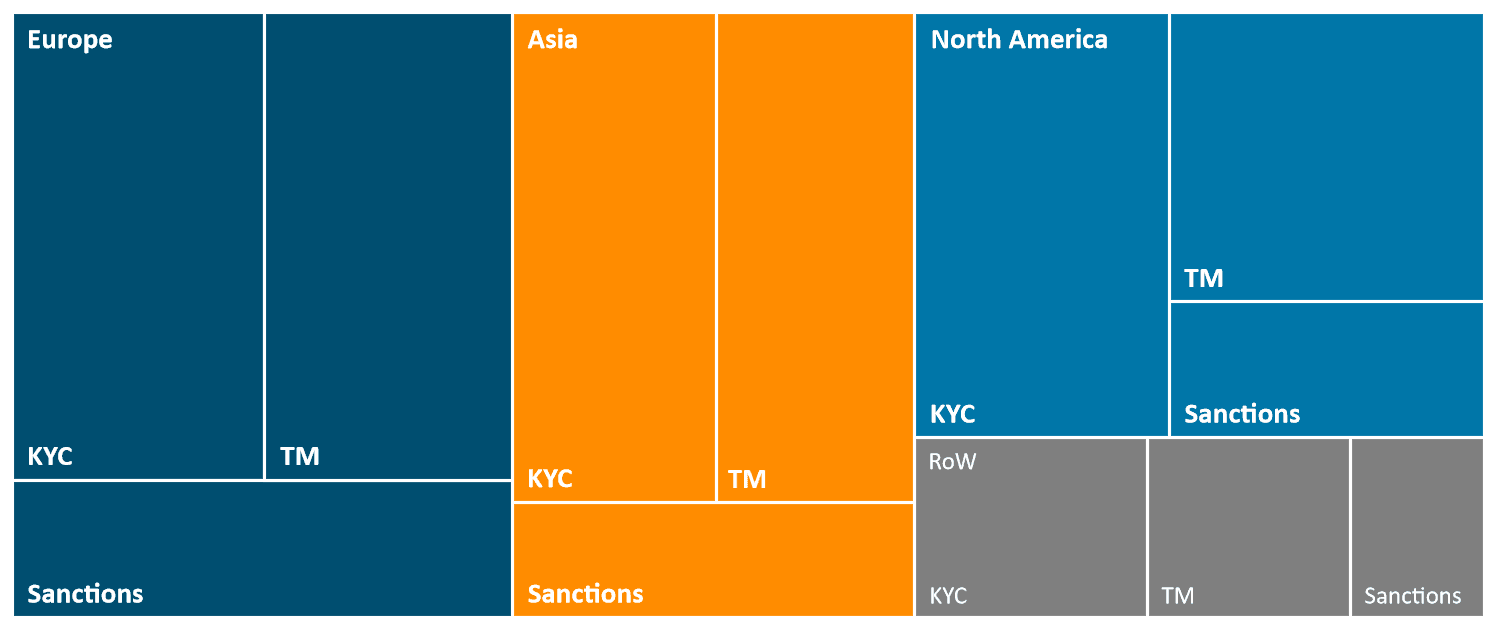

本レポートでは2023年に実施したCelent Technology Insight and Strategy Survey (CTISS) の結果をもとに、銀行、保険会社、証券会社、ウェルス/アセットマネジメント会社を含む世界の金融機関による金融犯罪コンプライアンス関連のIT投資額と業務コストを推定している。具体的には、世界全体の推定額と以下の項目別内訳を示している。