Celent recently completed the analysis of some small business research among a random sampling of 500+ small business owners with annual revenues up to $2.5 million. The universe of U.S. SMBs excluding those making less than $50k/year is roughly 25 million.

The research underscored the centrality of check payments among small businesses – like it or not. For example, 90% of responding SMBs accepted checks compared to 70% accepting cash, 33% credit cards, 31% debit and 28% PayPal (with large variations depending on type of business). And when asked “If you could be paid the same way each time by every customer –how would you choose to be paid?” Check (38%) and cash (33%) were the two favorites. This will change over time, of course, but for the mid-term, checks will remain commonplace among SMBs.

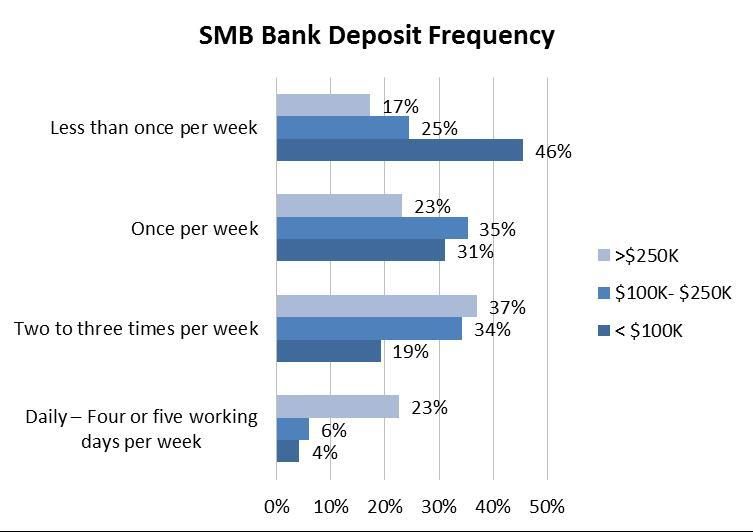

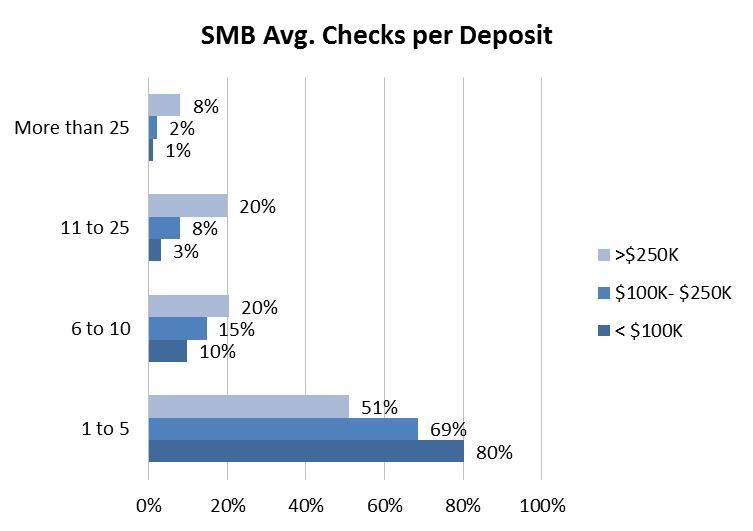

All these checks are producing a good deal of branch activity. In the same survey, businesses were asked how often they made check deposits and how many checks were in each deposit. The results were logical – the larger the SMB, the larger the average check deposit and the more frequently they deposited.  About two-thirds of all SMBs in the sample had less than five checks per deposit, making them suitable candidates for low-cost remote deposit capture (RDC) solutions.

About two-thirds of all SMBs in the sample had less than five checks per deposit, making them suitable candidates for low-cost remote deposit capture (RDC) solutions.  Why is small business RDC important? At least two reasons. Approximately 20 million small businesses are accepting checks on a regular basis and depositing them at local branches and ATMs. RDC represents an obvious convenience for these businesses. The second reason is the favorable impact RDC can have on branch traffic and the resulting cost to serve these customers. Using the surveyed deposit frequency shown above, the collective activity amounts to 3.6 billion bank deposits annually. Assuming these deposits were distributed equally among the nation’s 119,000 bank and credit union branches, each branch could see 30,400 fewer deposits annually if SMBs were enrolled in RDC en masse. That averages 117 branch deposits per day, or roughly a single teller per branch based on a teller efficiency of 18 transactions per hour. Larger banks that serve the majority of small businesses would enjoy the bulk of the savings. Financial institutions would do well to leverage RDC’s popularity by offering desktop and mobile RDC freely to small volume depositors, and aggressively selling more capable solutions to the third of SMBs with more substantial check deposit volumes. This needs to happen alongside realistic RDC risk assessments and a corresponding broadening of eligibility requirements and raising of deposit limits. Otherwise, RDC will remain a niche product that under delivers customer needs as well as product revenues.

Why is small business RDC important? At least two reasons. Approximately 20 million small businesses are accepting checks on a regular basis and depositing them at local branches and ATMs. RDC represents an obvious convenience for these businesses. The second reason is the favorable impact RDC can have on branch traffic and the resulting cost to serve these customers. Using the surveyed deposit frequency shown above, the collective activity amounts to 3.6 billion bank deposits annually. Assuming these deposits were distributed equally among the nation’s 119,000 bank and credit union branches, each branch could see 30,400 fewer deposits annually if SMBs were enrolled in RDC en masse. That averages 117 branch deposits per day, or roughly a single teller per branch based on a teller efficiency of 18 transactions per hour. Larger banks that serve the majority of small businesses would enjoy the bulk of the savings. Financial institutions would do well to leverage RDC’s popularity by offering desktop and mobile RDC freely to small volume depositors, and aggressively selling more capable solutions to the third of SMBs with more substantial check deposit volumes. This needs to happen alongside realistic RDC risk assessments and a corresponding broadening of eligibility requirements and raising of deposit limits. Otherwise, RDC will remain a niche product that under delivers customer needs as well as product revenues.