Tokyo, home to Asia’s largest capital markets, is also wonderful in May, and was a perfect location for two recent Celent roundtables.

The first was Exchange Panel: Drivers of Innovation and a Market in Transition. We invited Executives from five major global exchanges; CME Group, JPX Group, Korea Exchange, NYSE Euronext, and Singapore Exchange Limited. Representatives from both Asian and global exchanges discussed changing equities derivatives market structures, business models, challenges, and opportunities in Japan’s and Asia’s capital markets.

Though similar at first glance, the exchanges from the East and West presented a marked contrast. Asian exchanges insisted that competition, diversity, and deregulation are the keys to growth. Exchanges based in Europe and the United States said they found the diversity and competition excessive; they would prefer order and market discipline. All exchanges stressed the importance of innovation and collaboration, and all agreed the distinction between investment and speculation is important.

Such differences between East and West reflect the history of the global exchange business. Differences in time and distance are shrinking as networks grow, but, ironically, the advent of global capital markets has led investors to recognize the importance of individual trading venues.

For the second roundtable, The Capital Markets Revolution in Japan and Asia, we invited the top players. From online securities companies, Monex, Inc., from buy-side, Nissay Asset Management Corporation, and from sell-side, Nomura Securities Co., Ltd. This session focused on the emerging low latency landscape and the opportunities and challenges in the region’s equities and derivatives markets. In Japan and Asia, since the introduction of arrowhead, the latency has been lowered enough and the attention has shifted to its execution quality. Technologies such as Big Data and transaction cost analysis (TCA) are the focus of their challenges.

Finally, in response to questions from audience of the venue, we asked the panelist to comment on high frequency trading (HFT). There were two comments; one was “the opportunity to get everyone used to HFT is here”, and another “HFT is welcome in Japan”.

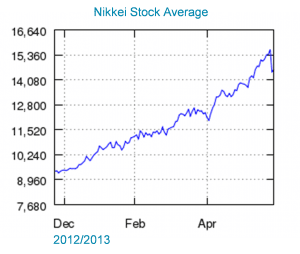

The market environment has changed drastically. Conversion of monetary policy, “Abenomics,” and the “three arrows” were a volcanic combination. Magma flowed, but all indicators began to rise.

FIG 1:Tokyo Equities Market last six months

These discussions will continue in New York in June. Celent will continue to explore the market trends of tomorrow. We are looking forward to meeting you again.

http://www.celent.com/news-and-events/events/sifma-tech-2013

http://www.regonline.com/builder/site/Default.aspx?EventID=1228293

http://www.regonline.com/builder/site/Default.aspx?EventID=1236023