The sun has been rising on the small business front. New data from the Small Business Administration Office shows that the number of small businesses increased 7% since 2020, up to 33.2 million. Celent research shows that small business loans are up 13% 2019 to 2021.

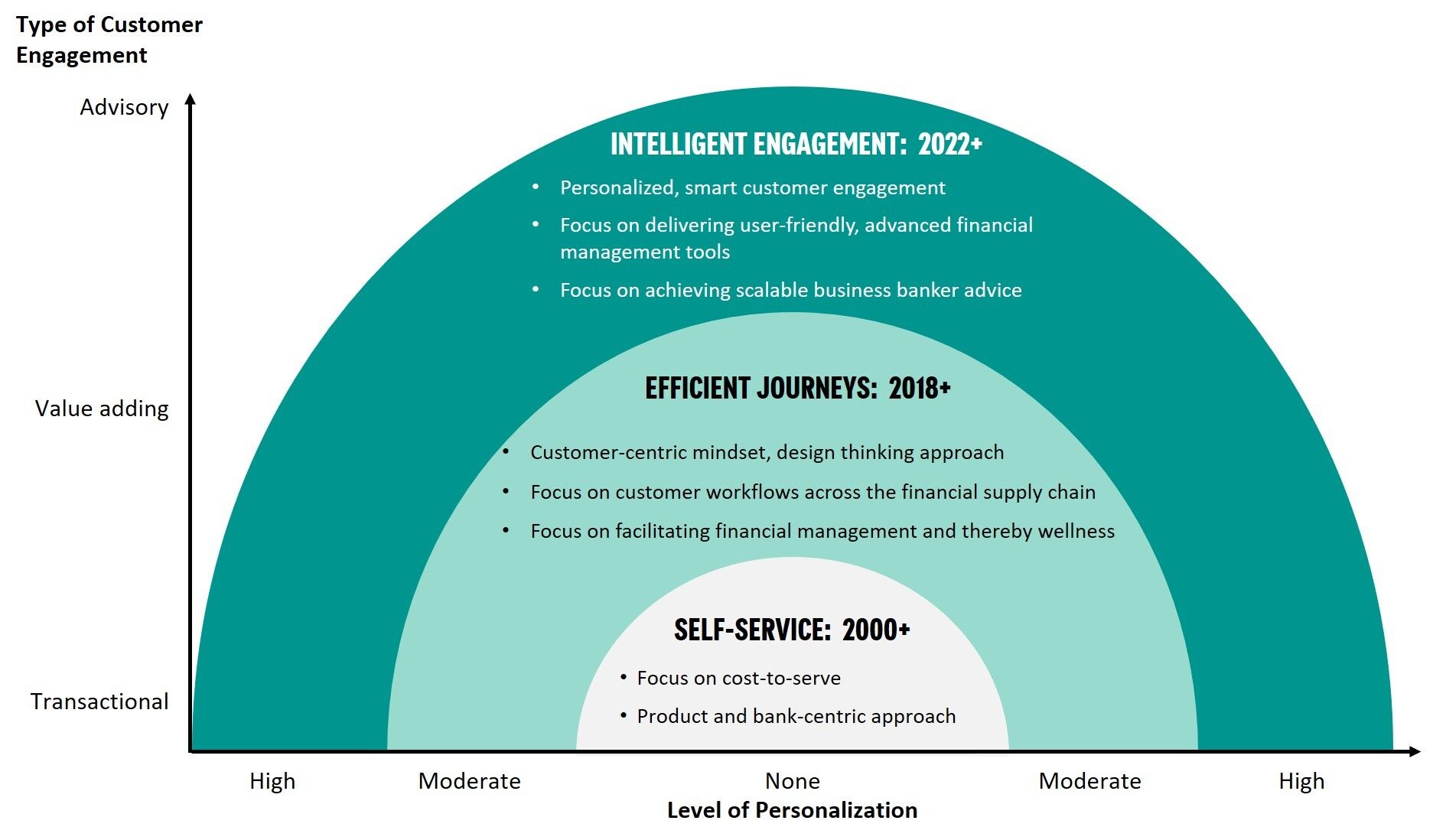

The game is on to win these new businesses through superior customer engagement. Celent has mapped out the new engagement horizons banks can aspire to reach. Until recently digital small business banking equated to self-service and was a homogenized experience. It was transactional with little to no customer engagement per se. Competitive differentiation was very limited. No longer. Bankers and their technology providers are pushing customer engagement to the next horizon: efficient journeys. They are digitizing customers’ workflows related to financial management and, in the process, enabling small businesses to operate more efficiently. They are delivering customization via flexible user interfaces comprised of templates for specific personas (e.g., makers, checkers, and approvers) and widgets. A few bankers and providers are reaching the horizon beyond: intelligent engagement.

Figure: Pushing New Horizons

Given small businesses’ relatively high cost-to-serve, banks have naturally focused on the cost end of small business banking economics. Despite investment in self-service and rising adoption rates, bankers report that small business customers still rely heavily on banker and call center support, effectively outsourcing the business financial manager/comptroller role to the bank. Banks have found that as they grow their small business customer base, they must also grow their call center and, to varying degrees, their branch capacity.

As a result, small business banking has been challenged by the trade-offs between lowering cost-to-serve and improving customer experience. To lower cost-to-serve, banks have implemented technology to standardize and drive self-service. They have limited investment in relatively higher-cost personalized service. As a result, small businesses are often underserved. This no longer needs to be the case. Banks that harness advanced technology and successfully partner to deliver value-added services can outcompete not only other banks but also the platform players—e.g., Strip and Square—that have been aggressively entering the market.

For further discussion, please see the Celent report, Small Business Digital Engagement: How to Outcompete. If you’re interested in pushing new horizons in small business credit, see the Celent report, Reinventing Small Business Credit Part 1: Market and Innovation Trends.