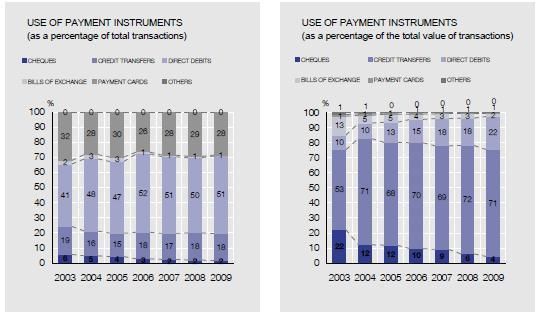

The latest big bank mobile RDC launch is by a bank holding company headquartered in Barcelona. Go figure! Banco Sabadell is the first Spanish bank to launch a mobile RDC service. Press release: http://press.bancsabadell.com/2011/01/banco-sabadell-presents-its-mobile-banking-innovations-for-2011.html The product’s menu: http://www.flickr.com/photos/bancosabadell/5367041115/ Banco Sabadell’s application has a familiar look and feel, closely resembling most mobile RDC applications launched by U.S. banks. What is surprising is that Banco Sabadell would beat so many U.S. banks to the mobile RDC punch – particularly considering the state of check (or cheque) payments in Spain. Cheques represent a small minority of payments in Spain (less than 2% of payment volume in the National Electronic Clearing System – SNCE, and about 4% of value in 2009) yet remain a part of everyday life  Personal cheques are rarely used in Spain, and are not accepted as a form of payment by most establishments. Yet, banks are of course, compelled to honor checks and process them expeditiously. As check volumes dwindle, the cost to process each item grows substantially. Checks have been truncated in Spain since 1990, through the Spanish retail payment system. Initially cheques over a certain value threshold still needed to be delivered to the drawee FI, but in 2003 the transmission of images began to replace the delivery of the physical cheques exceeding the threshold. By 2006, virtually all cheques cleared electronically. Remote deposit capture therefore presents a viable value proposition to both banks and their customers in Spain.

Personal cheques are rarely used in Spain, and are not accepted as a form of payment by most establishments. Yet, banks are of course, compelled to honor checks and process them expeditiously. As check volumes dwindle, the cost to process each item grows substantially. Checks have been truncated in Spain since 1990, through the Spanish retail payment system. Initially cheques over a certain value threshold still needed to be delivered to the drawee FI, but in 2003 the transmission of images began to replace the delivery of the physical cheques exceeding the threshold. By 2006, virtually all cheques cleared electronically. Remote deposit capture therefore presents a viable value proposition to both banks and their customers in Spain.