The Association for Financial Professionals (AFP) recently published its 2017 AFP Risk Survey Report of Survey Results. The survey, supported by Marsh & McLennan Companies (Celent’s parent company), provides a snapshot of the challenges organizations face in the current risk environment. Responses from 480 senior-level corporate practitioners (primarily based in the US) formed the basis of the survey.

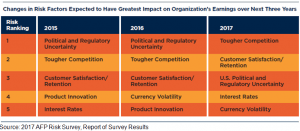

Corporate practitioners rank the highest risk factor impacting organization earnings in the next three years as tougher competition (40%), followed by customer satisfaction (33%), and U.S. political and regulatory uncertainty (32%.) While the three top-ranked factors are similar to those in the 2016 AFP Risk Survey, the order differs.

The survey authors made an intriguing observation on the ranking of risk factors: “It is interesting that in an election year (during which this survey was conducted), finance professionals believed competition would have a greater impact on their organizations’ earnings than would any uncertainty surrounding the U.S. political and regulatory environment.”

The report of survey results goes on to discuss risk mitigation actions in direct response to various types of risk. For example, in response to geopolitical risks, 60% of respondents are most focused on maintaining adequate liquidity, with a greater share of larger companies than smaller companies paying attention to maintaining liquidity (65% to 57%).

If you are a corporate banker or treasury management professional, I highly recommend a reading of the 2017 AFP Risk Survey results. The survey data provides valuable insights into the current and emerging threats facing US corporations of all sizes.