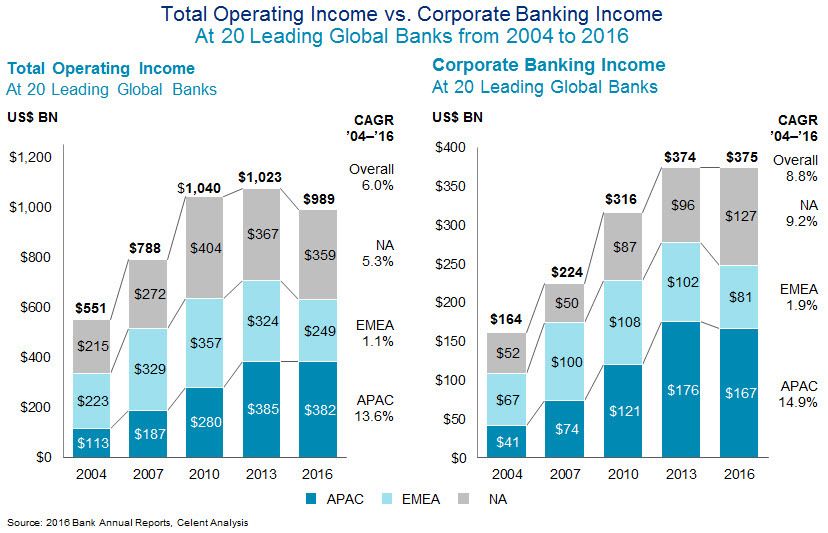

Corporate banking continues to play a dominant role for the largest global banks, with operating income growing year-over-year since the global financial crisis. Corporate banking operating income growth also continues to outpace total operating income.

In 2016, corporate banking was responsible for 38% of overall operating income across the 20 banks included in Celent’s recent analysis. The largest corporate clients often work with more than 20 banks, relying on these institutions to deliver an extensive set of products and services. Thus, banks that want to attract (and retain) a substantial piece of a corporate’s banking business must continue to invest in the technology infrastructure required to deliver an array of solutions across multiple corporate banking segments.