I had the honor of moderating a panel at this year's Sibos conference titled "AI and emerging tech: Making global trade safer and more efficient." I was joined by executives from DBS, Standard Chartered, Eastnets, and Amazon Web Services.

For those with Sibos Participant or Digital passes, you can access the entire session on the Sibos app. It was a thought-provoking session which I’ve summarized here – get in touch if you'd like to explore the topic further.

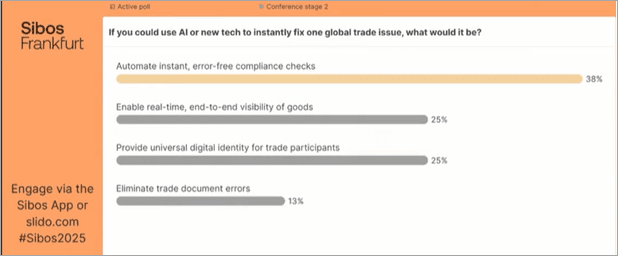

The panel opened with an audience poll asking the question: If you could use AI or new tech to instantly fix one global trade issue, what would it be? Here are the results, which overwhelmingly favor automating compliance checks.

Where are emerging technologies—AI, blockchain, IoT, digital identity—delivering the most significant measurable gains in trade today: in documents, customs, visibility, or somewhere we're not yet looking?

Emerging technologies, such as AI, blockchain, IoT, and digital identity, are beginning to deliver results in trade, although fragmentation, multiple participants, and extensive documentation still slow progress. Interoperability is improving, and blockchain supports the exchange of trade data, but digital identity and token standards remain unresolved.

Banks are digitizing key processes: DBS has 99% of its supply chain finance transactions fully digital, utilizing IoT and APIs for real-time inventory data and algorithmic lending. Standard Chartered uses document scanning for compliance and a collaborative tracking system for transaction visibility and is working with governments on document authentication.

These technologies improve efficiency, speed, and compliance, reducing manual work and clearance times. A major focus is on tackling trade-based money laundering, utilizing AI for pricing analysis, IoT for tracking, and automation for faster onboarding and enhanced fraud detection.

Interoperability has long been a challenge in global trade—is there an opportunity to share GenAI use cases and prompts in a controlled way? What about Agentic AI multi-agent interoperability and agent marketplaces?

Agentic AI enables vendors and organizations to offer their expertise as AI agents, rather than relying on human services. Emerging interoperability standards, such as MCP, allow not only transaction and settlement interoperability but also the automation of actions previously performed manually. Vendors, including professional services firms and data providers, are offering agents that banks or trade counterparties can license. These agents can collaborate, including across borders, to automate trade processes.

The Singapore banks have noted progress in using generative AI, although agentic AI is still in its early stages. Internal GPT-style tools can read policies and rule books, summarize key points in documents, and highlight areas that require human review, thereby reducing transaction processing times. AI also helps resolve false positives in AML and sanctions screening.

After a major commodity fraud in Singapore, banks created a Trade Finance Registry to prevent multiple financing of the same transaction. Banks submit anonymized transaction data, and the registry flags duplicates. The registry has been live for several years, with many global banks participating, and plans include adding provenance and tracking capabilities.

Can trade banks embrace AI, tokenization, and digital identity without creating new compliance and data risks—or are we just trading one set of problems for another?

Panelists highlighted several compliance concerns around interoperability in trade finance. Because trade is inherently cross-border, the movement of data between jurisdictions is a major issue, especially as more governments adopt strict data localization and sovereignty rules. One approach is to anonymize or synthesize data—an approach used in other parts of financial services—could make cross-border data sharing easier, but this has not been fully explored in trade finance. Another challenge is the inconsistent legal enforceability of digital signatures across different jurisdictions, which can create problems as transactions pass through multiple parties. Standardizing sanctions screening requirements across borders is also tricky, and questions remain about how liability should be allocated if something goes wrong within a complex, multi-jurisdiction transaction chain.

The panel agreed that emerging technologies such as AI, tokenization, and digital identity offer benefits but can also introduce new risks. These innovations can enhance scalability, operational efficiency, and fraud detection, but they necessitate careful consideration of regulatory and data privacy requirements. AI is already being used to detect trade-based money laundering, including overpricing, underpricing, and phantom shipments, although explainability remains a challenge. Tokenization enables faster settlement but may not comply with all regulatory frameworks. Digital identity can strengthen trust and prevent fraud, but it also creates risks if not adequately regulated. Global regulatory efforts—such as Singapore's legal frameworks, Europe's DORA requirements, and the UAE's digital identity regulations—are helping address these challenges. Companies must ensure compliance, maintain data transparency, and build regulatory requirements into their technology solutions to balance innovation with risk.

Looking ahead to 2030, what does a truly safe and efficient global trade ecosystem look like?

Generative AI introduces non-deterministic outputs, requiring extensive guardrails and post-processing to ensure accuracy and regulatory compliance. One solution is to decentralize model training and agentic systems, which can improve interoperability and enable vendors and banks to deploy AI agents for customer interactions.

It will be important to emphasize managing risk rather than eliminating it, combining automation and human oversight in trade transactions. Panelists stressed the importance of digital identity frameworks to enable selective, cross-border data usage and support scalable operations. The vision is that by 2030, 60% of global trade will occur on digital platforms, relying on universal digital identities, regulated tokenized payments, and AI-driven compliance to build a trusted, efficient, and inclusive trade ecosystem.