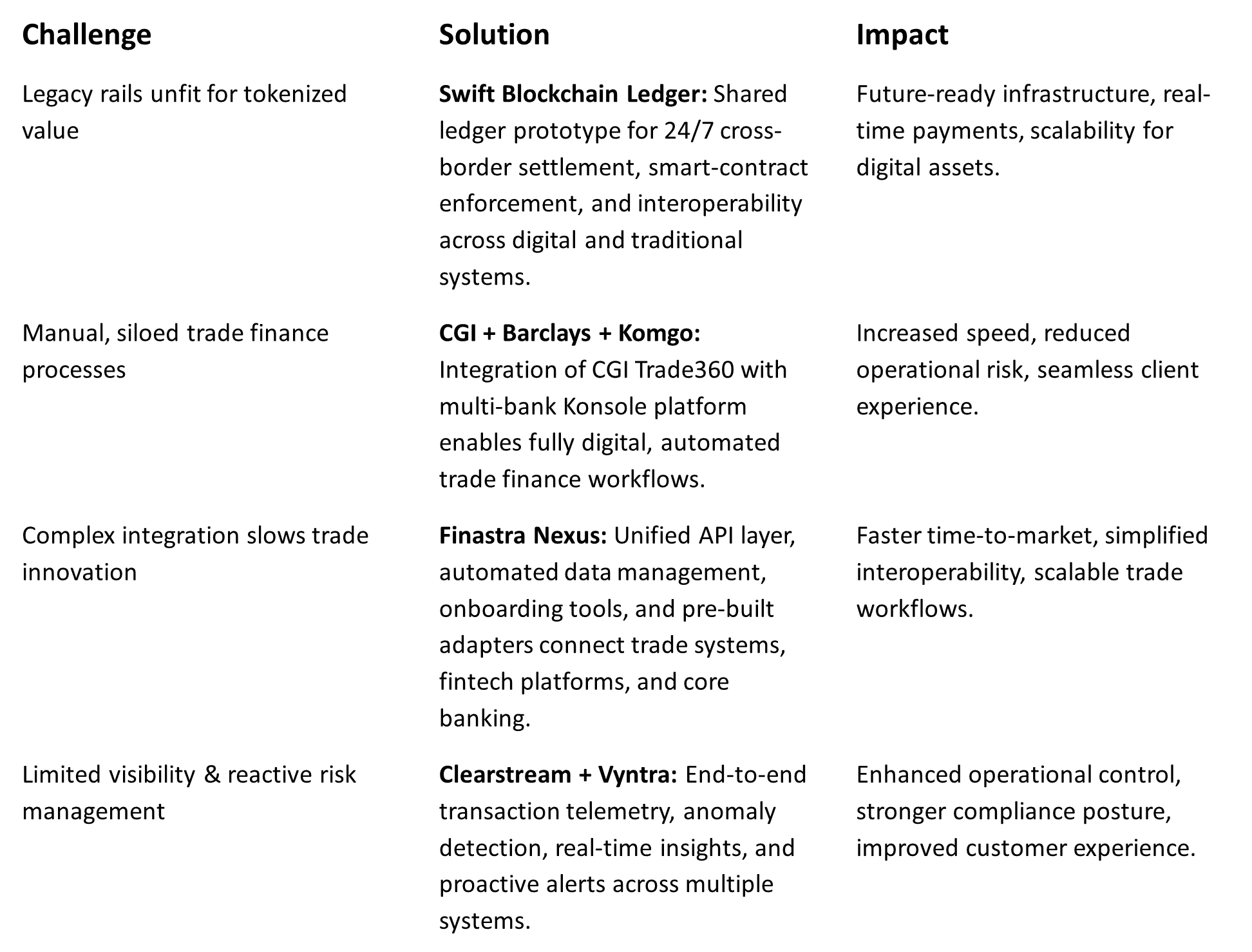

At Sibos 2025 in Frankfurt, one theme was impossible to miss: the trade finance industry is moving beyond incremental digitization toward integrated, intelligent, and interoperable infrastructure. From blockchain settlement prototypes to API-driven trade ecosystems, press releases this year point to the next phase of modernization — where automation, visibility, and collaboration converge to reshape global trade operations.

Imperatives for Banks

-

Accelerate API-driven integration Banks that unify trade and supply chain workflows—across internal systems and external platforms—will launch new services faster and adapt more readily to ecosystem change.

-

Invest in real-time intelligence and observability Proactive risk and compliance management will increasingly depend on telemetry, anomaly detection, and predictive analytics across transaction lifecycles.

-

Prioritize digital-first client channels Automation and connectivity are now baseline expectations. Trade finance clients demand instant visibility, self-service options, and frictionless digital workflows.

-

Prepare for tokenized value infrastructure Swift’s initiative marks the next evolution in global payments. Institutions should evaluate how digital assets, regulated tokens, and 24/7 settlement models align with their operating and technology strategies.

-

Adopt an ecosystem mindset Partnerships like Barclays–CGI–Komgo reflect a shift from closed systems to open collaboration. Banks that orchestrate networks rather than simply build platforms will capture greater client value.

The announcements at Sibos 2025 mark a clear inflection point. The industry is moving beyond incremental digitization toward integrated, intelligent, and interoperable financial infrastructure. Banks that modernize integration layers, embed analytics, and prepare for digital assets now will gain a lasting competitive edge as trade finance and cross-border payments converge into a new digital operating model.

CGI partners with Barclays to integrate multi-bank trade finance platform