The investment industry is undergoing significant transformations, influenced by cost and profitability pressures, as well as advancements in data capabilities and the emergence of new AI technologies. Celent's buyside investment technology surveys reveal a strong resurgence in data enablement themes.

However, while data is widely recognized as a strategic asset, effectively navigating the often complex and traditionally challenging journeys of data enablement to fully leverage this asset is not always straightforward.

There is no one-size-fits-all solution. The diverse data enablement needs and intricate data value chains within organizations necessitate that firms adopt cohesive 'data-first' information strategies and align their technology approaches, rather than simply conforming to the operational frameworks, data models, and technology strategies dictated by solution providers.

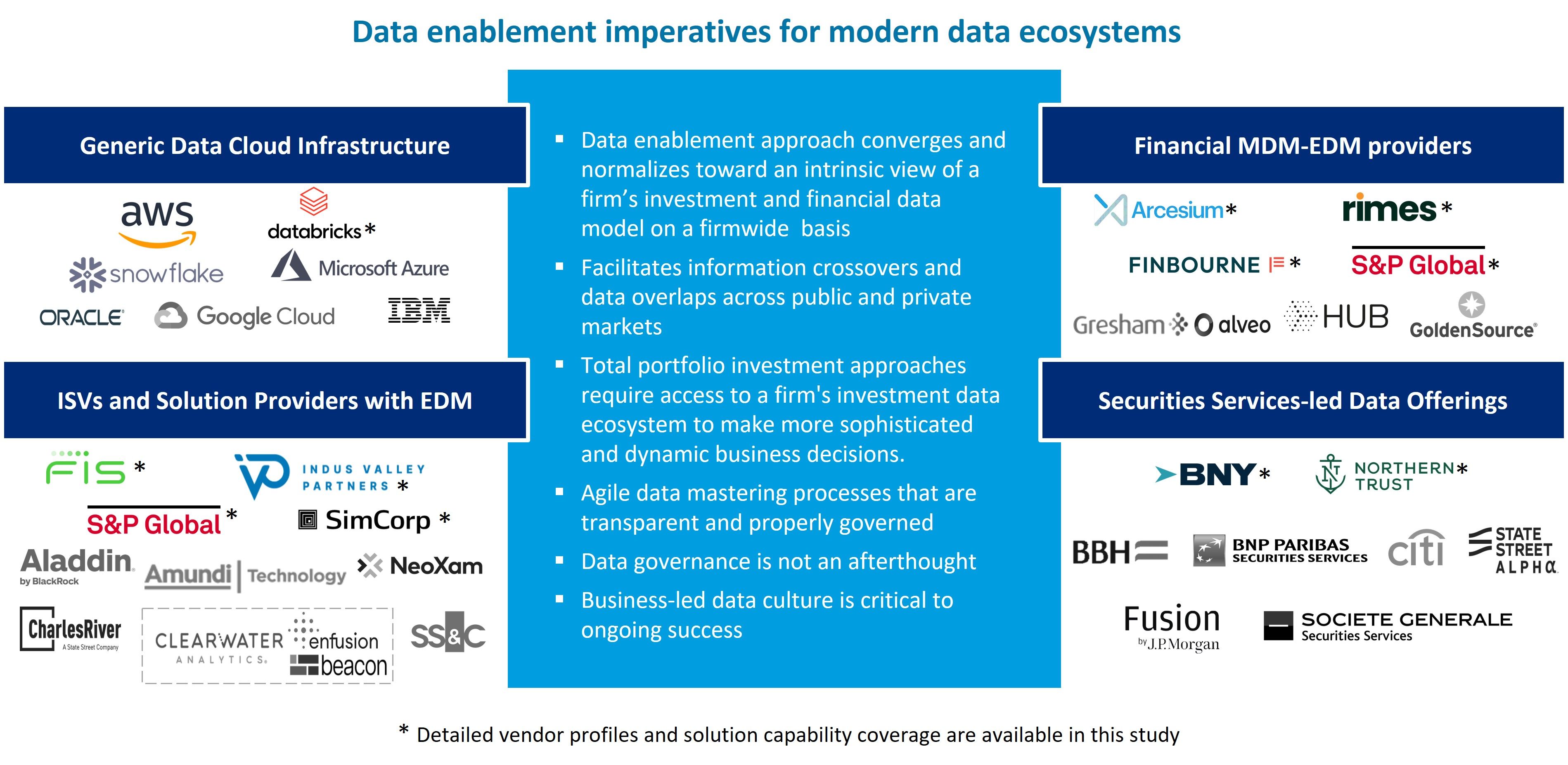

This study explores the landscape of investment data ecosystems, comparing different provider archetypes in optimizing data enablement strategies. As organizations strategically shift to improve their data enablement capabilities, investment firms must navigate and understand the various intricacies of provider platforms and go-to-market strategies. It is essential for the business to effectively utilize ecosystem provider archetypes to maximize their impact in data enablement initiatives. This report contains detailed vendor profiles and comparisons of solution capabilities. We outline and emphasize critical considerations and success factors for selecting new investment data platforms.

The information and insights presented in this market study can be used to:

-

Inform a firm's IT strategy and technology investments by drawing on Celent's survey and interview-led quantitative and qualitative insights that track market developments, digitization themes, and AI/data enablement practices across the financial industry.

-

Conduct soft benchmarking of your firm's capabilities vis-à-vis external solutions.

-

Gain insights from peer case studies, including those featured in Celent’s annual Model Awards, which recognizes innovation and technology excellence.

-

Develop long and short lists during vendor assessment and selection processes.

----------------------

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Other companion studies include:

- Investment Data Ecosystems (Part 1): Sharpening the Data Enablement Edge in an Age of AI

- Investment Data Ecosystems (Part 2): Reimagining Strategies & Tactics for Beyond the Here & Now

- Dimensions: Global Capital Markets/ Buy Side IT Pressures & Priorities 2025, Global Edition

- Top Technology Trends Previsory (Capital Markets): Buy Side, 2025 Edition

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- ESG Data Management in Capital Markets: A Time of Opportunity

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

- ESG Delivery Under Scrutiny; “Walking the Talk” to Resolve the Credibility Gap