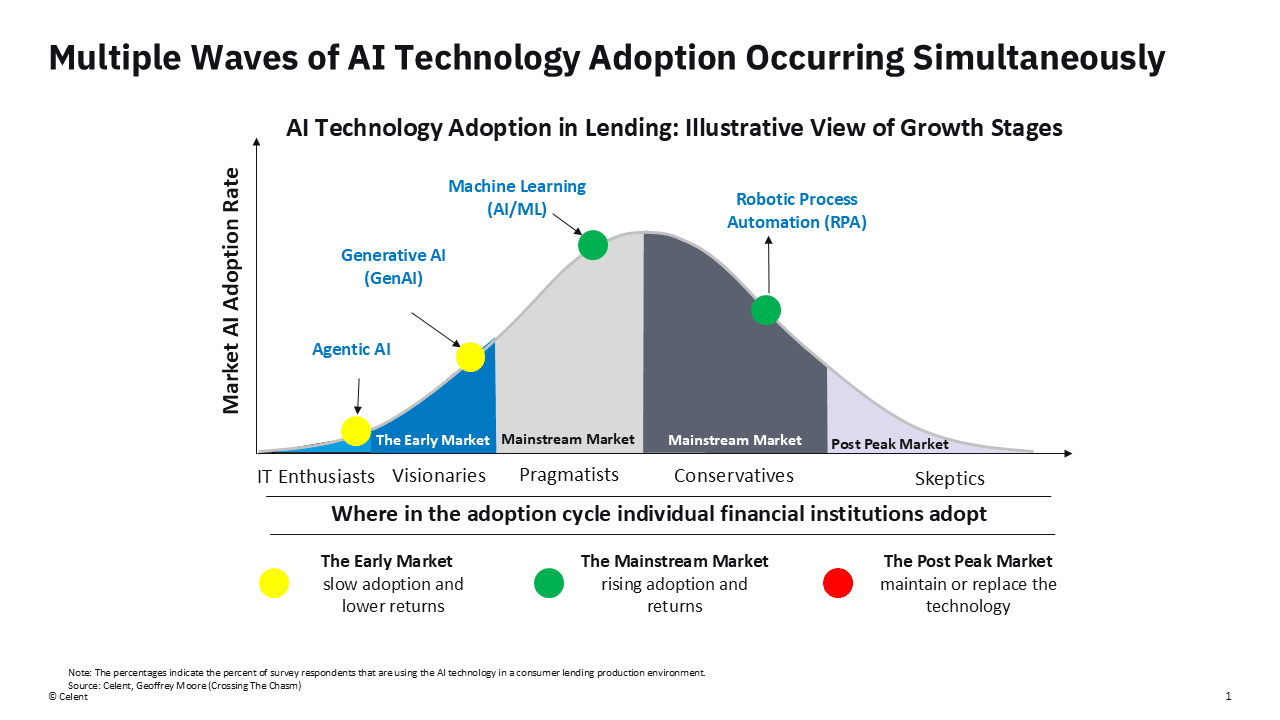

For many years machine learning (AI/ML) and robotic process automation (RPA) were the next big things in artificial intelligence and automation. Within the past two years generative AI (GenAI) has became the next big thing and agentic AI emerged in late 2024. For retail lending institutions, its not a question of whether or not to invest in AI, it is how much to invest, where to invest, and how fast to adopt all AI technologies to keep up with or stay ahead of the competition.

Virtually all financial institutions have experimented with, adopted, or are now testing various forms of AI. What differs between/among them is how comprehensive their long-term business and technology plans are, their approach to identifying use cases, how they implement, and how well they are measuring results.

Celent’s Top Insights for Generative AI in Lending Survey highlights a strong appetite for GenAI adoption, although security and compliance remain hurdles that are being overcome.