Digital banking platform (DBP) capability has evolved significantly since Celent's 2022 vendor comparison. First, some leading functionality then has become table stakes today. Second, Celent finds new areas of differentiation emerging, including new models that represent a clear divergence from the offerings of just two years ago. As a result, choosing a new DBP today will be far more impactful on a financial institution’s (FI) future success than in years past.

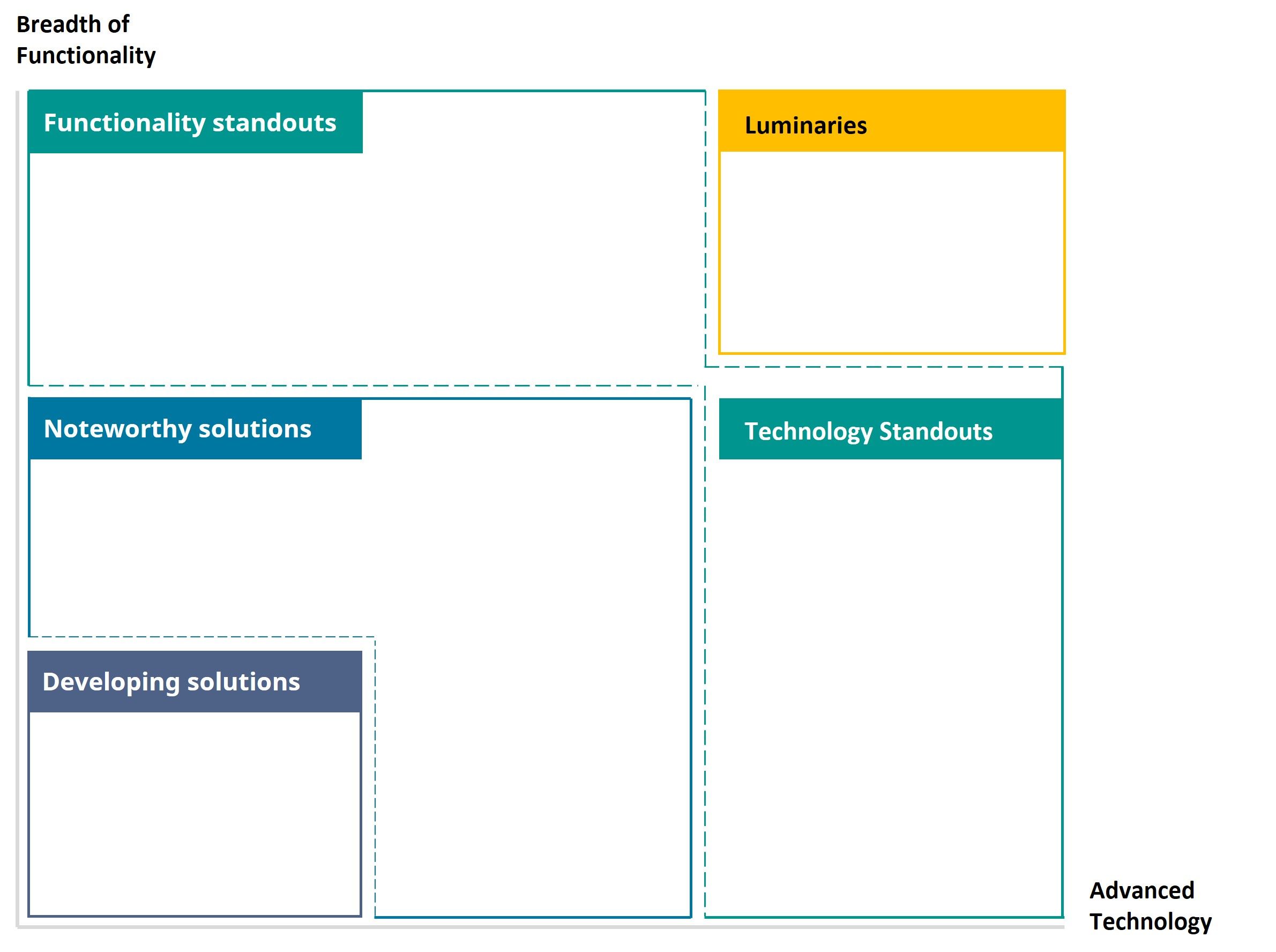

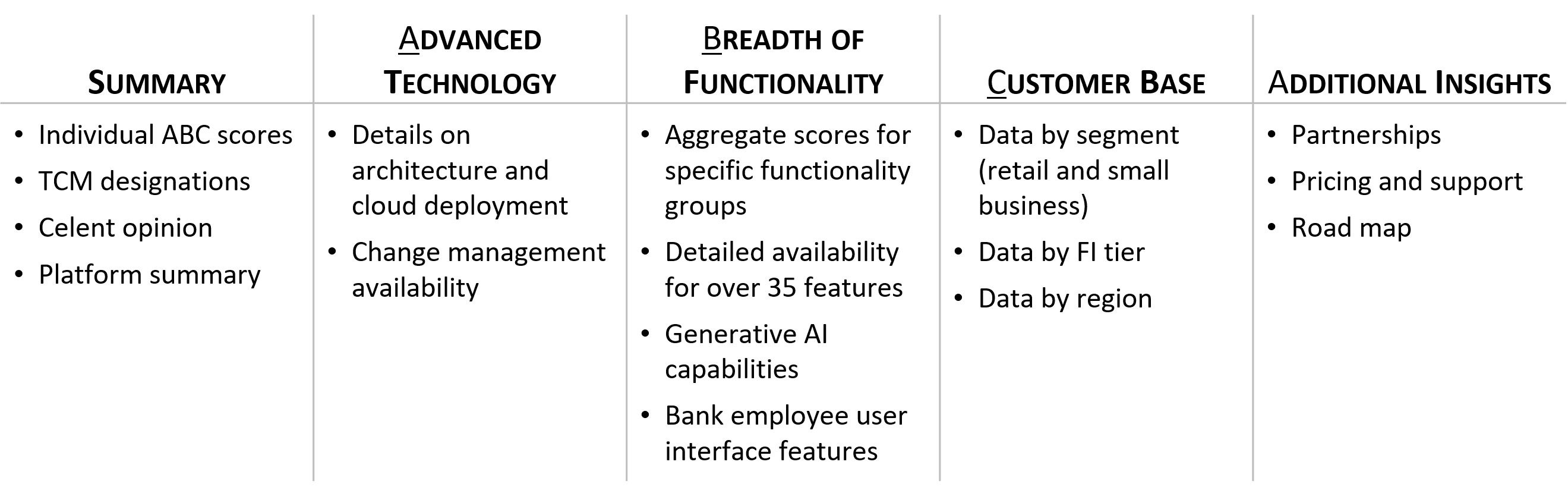

To help financial institutions (FIs) better understand current trends, the vendor landscape and compare vendors, we have undertaken a robust DBP vendor analysis using Celent’s ABC methodology, which awards vendors an XCelent across three dimensions: Advanced Technology, Breadth of Functionality, and Customer Base. In addition, we array all vendors in our Technology Capability Matrix with designations below.

Our methodology offers unrivalled comparative analysis across critical decision dimensions. In addition to Celent’s comparative analysis, we have compiled rich vendor profiles that each include a solution overview, advanced technology assessment, key functionality reviews, customer base measurements, pricing, and support characteristics.

Financial institutions and vendors alike will find value in this report.

This report is one of five XCelent Award reports covering small business DBPs. • North America Community Financial Institutions (CFIs) • North America Mid-Size to Large Banks • Asia Pacific, EMEA, and Latin America editions

A preamble report that outlines the entire digital banking platform space is also available: Decoding Small business Digital Banking Platforms: Spotlighting Functionality and Technology Innovation (March 2025). In addition to the small business DBP reports, Celent is publishing five reports for retail DBPs.

All our XCelent Awards reports are powered by our VendorMatch portal, which includes additional vendor insights.