We’ve sliced and diced the data from sell side respondents to this year’s Dimensions Survey to offer insight into key takeaways around IT Budget Pressures & Priorities. Highlights include:

- The increasing rate of emerging technology adoption may be behind a rise in IT spend on change

- IT budgets continue to grow, albeit modestly, as sell side firms balance efficiency and innovation needs

- Change is in the air for systems with a majority of respondent planning to upgrade/replace critical systems

Sell side firms continue to see strong revenues from Markets-related divisions, with macroeconomic and political factors supporting continued high levels of volatility and volume. The business and political environment is increasingly volatile however, with heightened recessionary risks stemming from global trade tensions and policy uncertainties as the economic paradigm moves away from globalization to modern mercantilism.

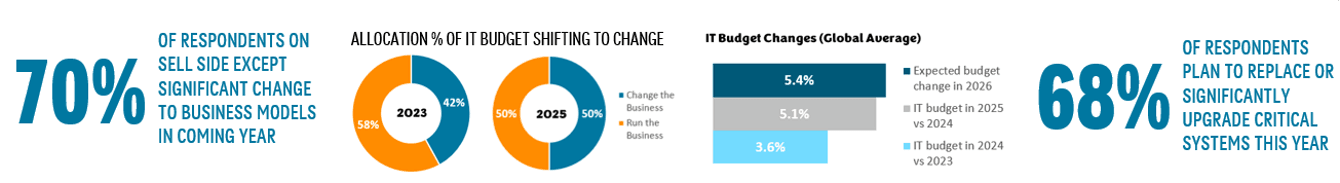

With 70% of survey respondents expecting to see significant changes to business models this year, sell side firms’ technology must be ready to help firms take advantage of revenue opportunities when they arise and be able to lean into new business revenue models. The technology investment must be carefully balanced to support agility and provide optionality to the business.

In this year’s sell side survey, the context for IT budgets for 2025 and 2026 continues to show cautious growth investment, with single-digit growth apparent across most regions, although the trend continues to be positive YoY. While legacy modernization remains a key driver of IT spend, so is the need for agility; there is awareness of the need to balance efficiency with growth spend.

The journey toward digitization, advanced data analytics, and AI continues, tempered with a respect for security challenges ahead with AI, cyber and blockchain technologies scoring highly for focus.

Findings from the survey reveal that the top drivers of IT investment on the sell side are focused on those that help meet the volatile and changing nature of the business environment. With 68% of sell side firms telling us they plan to replace or significantly upgrade one or more critical systems this year, this could be a critical year for solution and service providers.

In this year's "Dimensions IT Strategy & Priorities Capital Markets Sell Side 2025" report, we provide insights into the specific technologies, product investments, and strategic priorities that shape the agendas of global sell side firms across North America, Europe, and Asia. This analysis is based on survey data collected from a diverse range of stakeholders, including investment banks, brokers and custody/asset servicing banks. By understanding industrywide trends across peers, firms can better align their strategies with the evolving demands of the market.

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Relevant companion studies from Celent's body of research insights include:

- Dimensions IT Pressures & Priorities, Capital Markets Buy Side 2025, Global Edition

- Shedding Light on Agentic AI in Capital Markets

- Corporate Actions Processing in the Age of AI and Blockchain

- Closing the Gap on Treasury Clearing

- Top Technology Trends Previsory (Capital Markets): Sell Side, 2025 Edition

- Field Guide to GenAI Hyperscalers: Capital Markets Edition

- GenAI-oneers in Capital Markets: FI Survey on adoption and impact

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2.

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets