Transforming the customer experience is increasing in priority for insurers around the world.Successful transformation combines a number of key dimensions including cutomer centricity, the use of data to drive the experience, a broad set of partners, and real results.

Cathay Life has a strategy of differentiation through delivery of a highly differentiated customer experience. Their customers increasingly prefer to engage online and rely heavily on a digital channel to educate themselves prior to making a decision. Cathay Life initiated the ACE project to create an experience that would resonate more effectively with this highly digital customer base.Their intent was to strengthen the customer experience and enhance customer satisfaction across three stages of the customer journey: Acquisition, Communication, and Engagement.They needed to provide their customers with a broader set of digital capabilities, backed with rich data and sophisticated analysis of that data in order to provide appropriate support. They also needed the solution to be engaging enough to increase customer interactions with the company. And they were committed to delivering simple, smart, and safe online services for their clients.

The initiative includes the following:

·New products for both life and health.

·Online customer servicing tools, including a chatbot, agent support through a new CRM, games, and an automobile and insurance check-up tool.

·Artificial intelligence to better target customers and customer support through a new CRM.

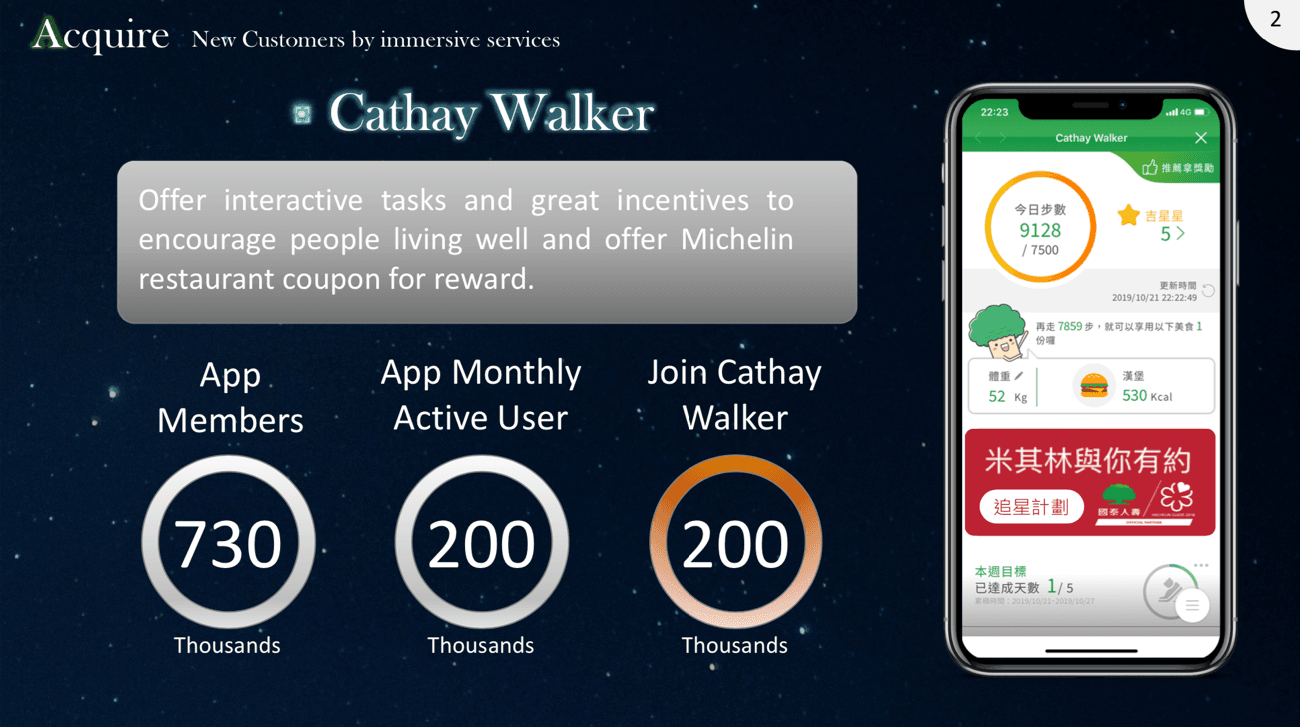

·Significant gamification techniques, including points for healthy behavior, with tangible rewards through a partnership with Michelin.

Cathay Life also launched a uniform customer ID to be used across all divisions including their bank to drive a more effective uniform customer experience and more robust analysis of the customers.