Mobile is much more than just a self-service channel; it’s a critical point of interaction between the bank and its customers. Banks are looking at growing top line revenue, and mobile customer acquisition is a significant strategic opportunity.

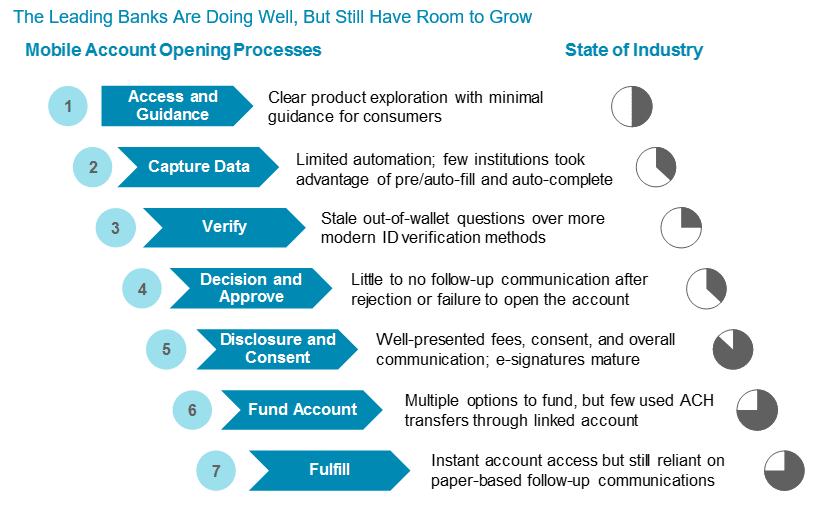

Mobile account opening is in its infancy, and banks are trying to grapple with competing priorities and new challenges. Large banks far outpace the industry in support for mobile sales, specifically for checking, savings, credit, and prepaid. Regardless, just supporting mobile onboarding does not mean the experience is pleasant. Improving or offering mobile account opening should be a strategic objective for all institutions that believe digital is a competitive necessity.