ESG criteria promotes doing business for good and holds organization accountable for actions that are damaging to the people and planet it aims to serve. Technology is the tool for enablement and helps materialize the thoughts and processess in accordance with ESG factors. The guiding recommendations are the United Nations Sustainable Development Goals, which promote 17 goals that can provide for a more sustainable future. Insurers, reinsurers, and brokers are doing their part through commitment to ESG business strategies and the development of risk assessment tools. Most notable are actions for protecting against climate change, with data analytics and blockchain technology providers playing a role in predicting and insuring against changing climate events.

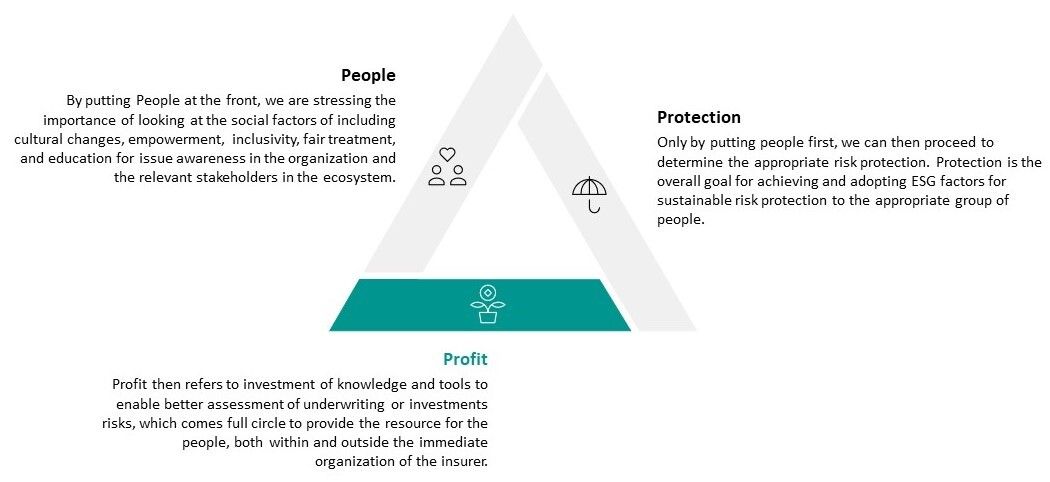

We will illustrate the consolidated thinking about ESG and insurance - focused on People, Protection, Profit. This is an insurance perspective to the triple-bottom line of Profit, People, Planet found in business concepts.