規制当局による厳しい監視は、金融犯罪コンプライアンス業務の欠陥を露呈しており、デジタル・ソリューション/チャネルの急増は、取引の量および速度の急増を引き起こしている。従来のツールは、増大する取引量および複雑性に対処するには適していない。

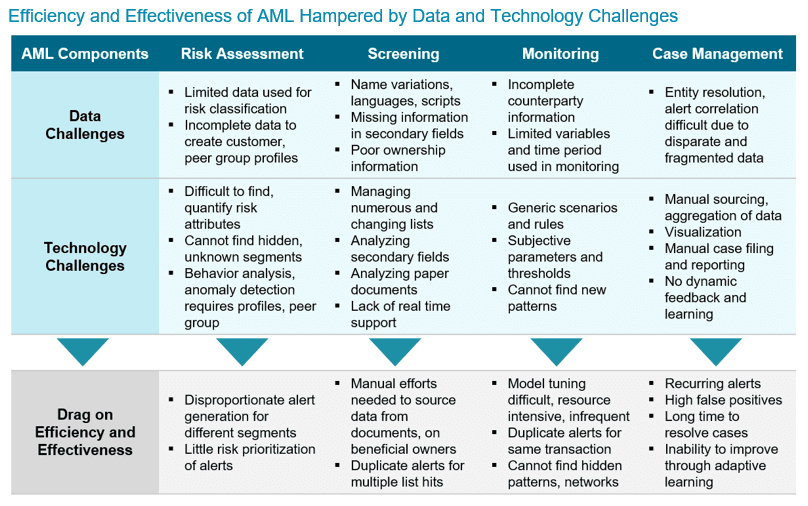

縦割りの業務、次善のデータ管理プラクティス、およびルールベースのテクノロジーは、リスクの最適なモニタリングを実現することができず、コンプライアンス・プログラムを非効率的で効果のないものにしている。手作業への過度の依存は、急速にコストを上昇させており、現行の業務を持続不可能にしている。