AIはUIに変革をもたらし、それによって顧客エンゲージメントも変わるだろう。セレントはバンキング業界での動きを追跡するため、新たに「UIにおけるAI」をテーマにした情報提供依頼書(RFI)を作成した。これは、現在および将来のAI採用状況、主要なユースケース、その基盤となるビジネスケースをベンチマーク化する試みとなる。

セレントは、コマーシャルバンキングとリテールバンキングの2つの分野について、RFIの回答に基づくレポートを発行する予定である。本レポートはリテールバンキングに関するレポートの第1弾で、RFIの回答から重要ポイントをまとめたものである。第2弾のレポートでは、フロントオフィス向けAIアプリケーションを手掛けるベンダーについて評価する。第3弾では、先導役となる銀行の動きを取り上げる。

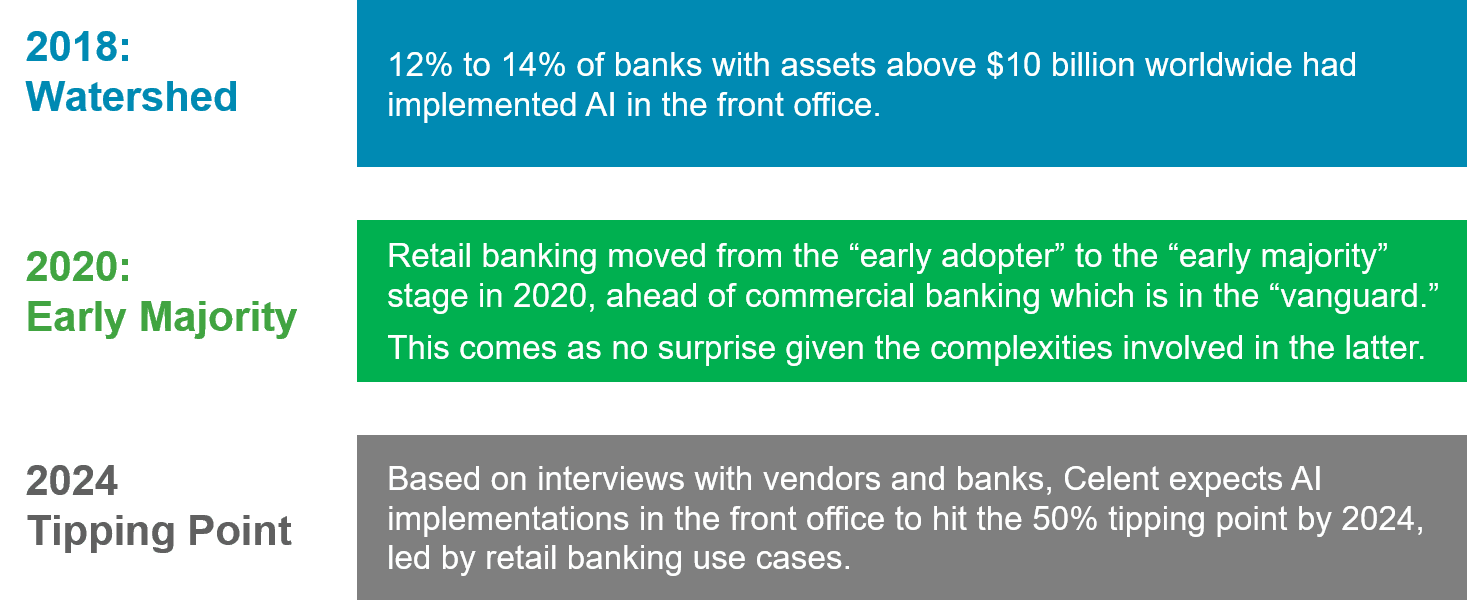

セレントは世界中の主要AIソリューションプロバイダーにRFIを送付し、2019年に24社から、2020年に16社からそれぞれ回答を得た。その回答内容とAIソリューションを自社開発する銀行の調査結果に基づくセレントの見積もりでは、資産総額が100憶ドルを超える世界の金融機関のうち28%はフロントオフィス向けAIソリューションを実際の業務に導入している。2019年の調査ではこの割合が24%だったことから、1年間で16%増と大きく伸びたことがわかる。

バンキングにおけるAI利用について様々な情報が飛び交う中、我々はユースケースとビジネスケースの分析を行った。その結果、ベンダーがプロダクション環境でサポートしているユースケースの過半数(67%)はデジタルチャネルを通じて顧客に直接提供されるサービスに関連していることがわかった。また、先行組の銀行が導入する独自のソリューションも同じ傾向にあることが、銀行への取材から明らかになった。コーポレートバンキングでは、対面での顧客サービスに関するユースケースは過半数をやや上回る水準にとどまった(54%)。コーポレートバンキングで対面接客が可能なAIを導入するのはリテールに比べて難しいことから、この結果は当然といえよう。今のところ基本的な顧客サービスに関するユースケース(「対話に応じる」タイプ)が主流だが、より高度なユースケース(「助言を提供する」タイプ)の実用化も進んでいる。その結果、基本的なビジネスケースのコストも抑えられる。特に、想定されていたコスト抑制を既に実現している銀行の間では、顧客エンゲージメントの向上を目指す動きが広がりつつある。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)