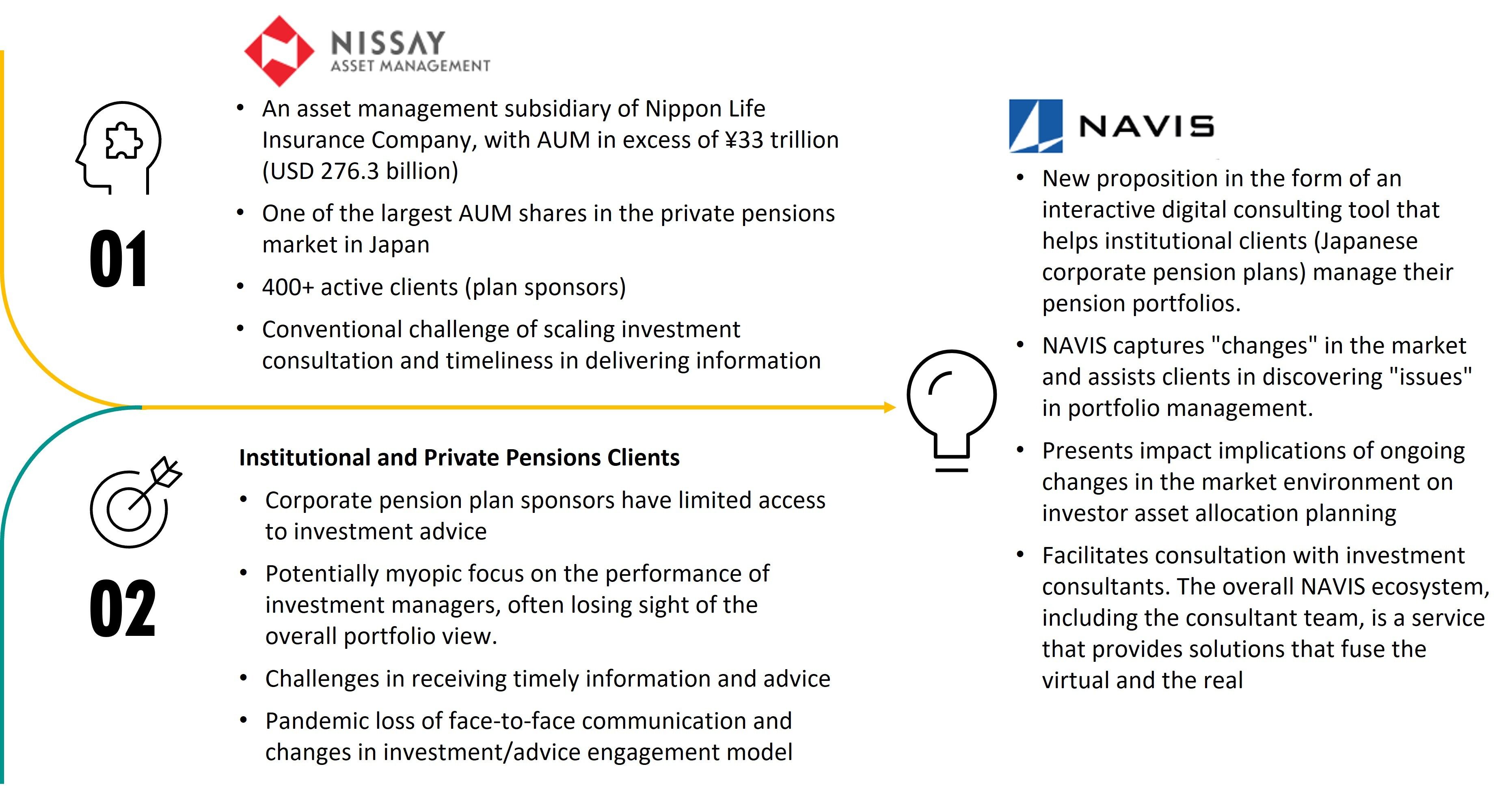

Corporate pension plan sponsors conventionally operate in an “analog mode” where they have limited access to investment advice, with timely or real time market and portfolio information delivered on a lagged basis. It is common to focus myopically on the performance of investment managers, but such an approach often loses sight of overall portfolio dynamics and opportunities for optimization.

It is in this context that Celent recognizes Nissay Asset Management’s NAVIS offering for employing digital paradigms to extend and expand their channel interactions with the corporate pensions market and to leverage next-generation technologies and analytics to monitor, plan, and optimize their asset allocation activities in a proactive, forward-looking manner.

Nissay Asset Management’s NAVIS digital client proposition represents an industry first in the Japanese corporate pensions market. This digital offering enables corporate pension plan sponsors, who have traditionally had limited access to investment advice, to receive more timely information, advanced investment analytics about their asset allocations, and active consultation with consultants. As shown by Nissay’s own positive customer feedback pertaining to this initiative, new propositions like NAVIS are increasingly valued for their higher levels of convenience, immediacy, and value for money.

New propositions such as NAVIS, illustrate the growing ambitions and potential across the investment industry for digital technologies to be more widely employed in sales methods, customer service, and products. In this case study, Celent examines Nissay Asset Management's strategic rationale, business ambitions, technology underpinnings, and delivery success factors for the NAVIS initiative.