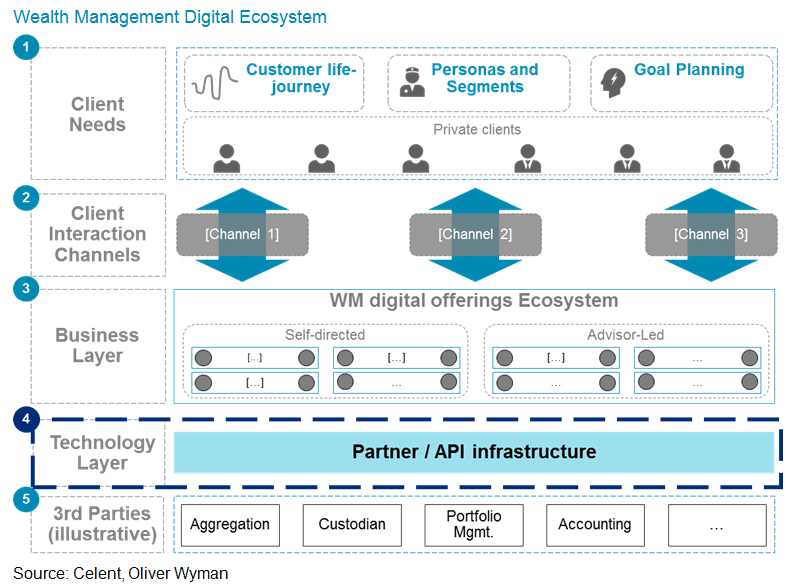

Incumbent wealth and asset management technology providers are looking to evolve into fully API supported platforms. Asset managers, brokerages, independent broker-dealers (IBDs), and registered investment advisors (RIAs) are also looking to improve their digital offering via APIs.

Incumbent wealth and asset management technology providers are looking to evolve into fully API-supported platforms. APIs are known to reduce costs and improve interoperability, but how do API platforms create new revenue? This report will clarify the role of microservices and Integration as a Service (IaaS) in wealth management, as well as explore potential monetization schemes.