The re-emergence of RMS will be the nerve center for capital markets players amid post-pandemic uncertainty. Now is the time to maximize emerging technologies in investment strategies.

Celent believes the use of new technology and the proliferation of alt data at financial institutions will significantly contribute to the modernization of investment information strategies in capital markets. Also, the explosive surge in data and tools has been accompanied by growing demand for systems to record front office transactions at buy side financial institutions. What investment units need is a system capable of executing decisions, managing, developing, and tracking based on these new data sets—in other words, this is precisely a job for RMS.

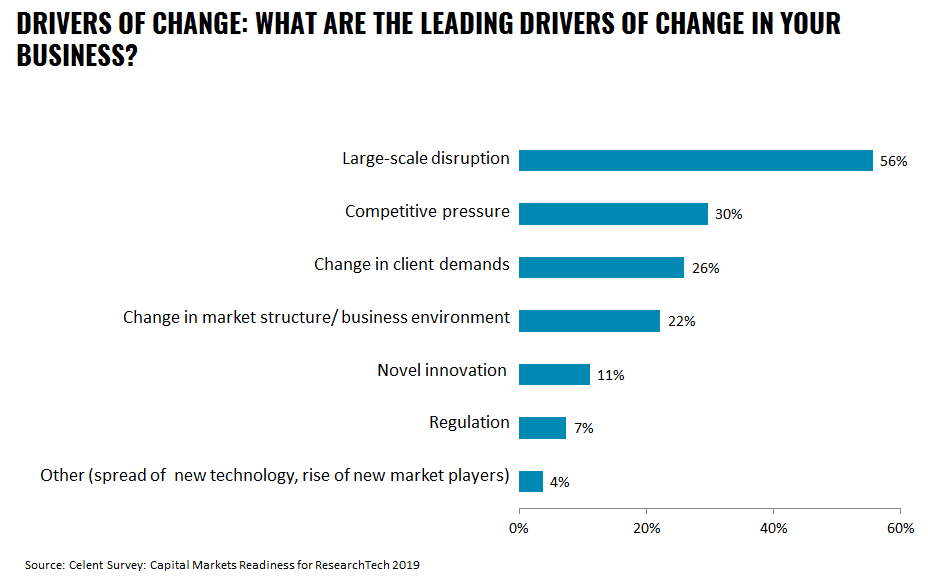

The results of Celent’s Japan CM RMS survey showed that market participants are only just starting their RMS efforts.