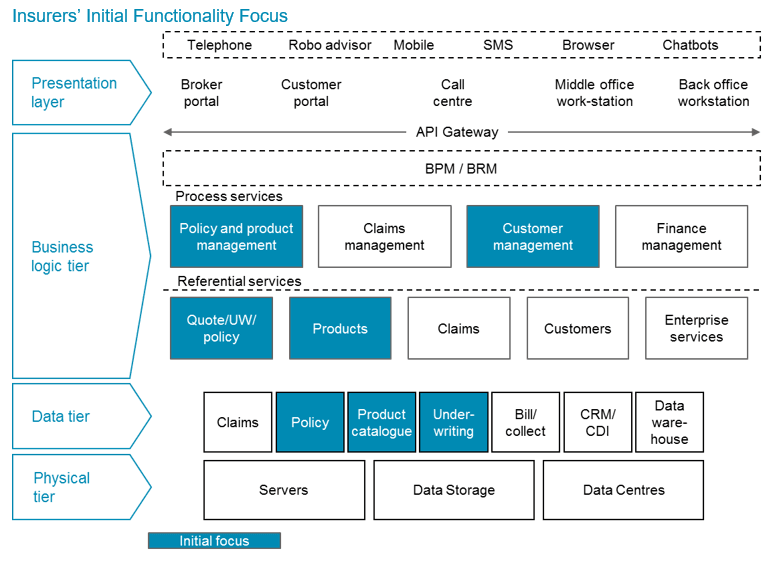

Insurers are increasingly looking for cloud-native core insurance systems that leverage APIs and are microservices-oriented. Their focus is to launch, deploy, and sell new insurance propositions quickly, so front end components enabling digital processes are key. However, it is not always easy for them to find the right balance between flexibility, digitization, and speed and getting the required capabilities along the whole value chain.

The requests Celent has received suggest that large or enterprise-scale system deployments are too slow and too costly to satisfy these niche plays.