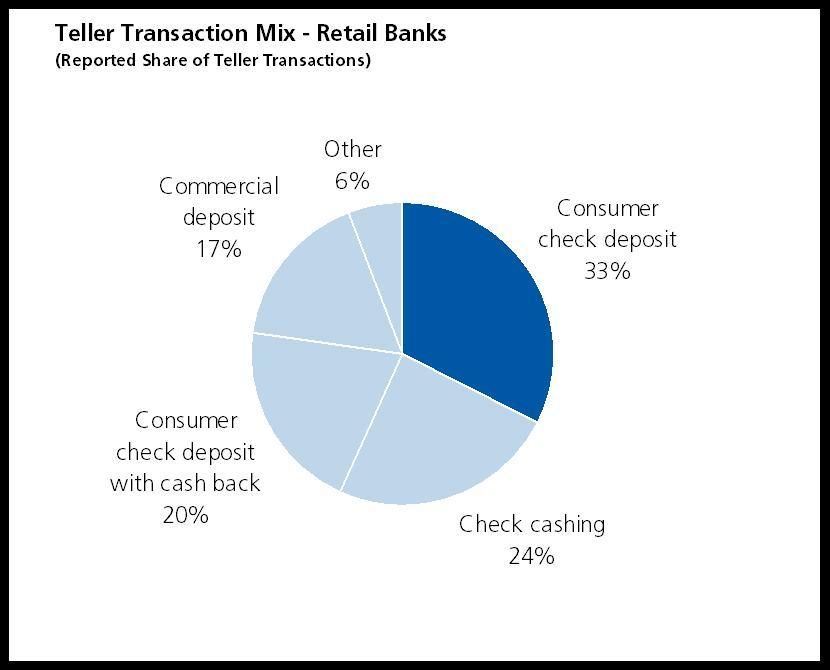

"A Different Kind of Bank: Why you’ll Never Need a Branch Again" was the title of last evening’s USAA Webinar merchandizing its mobile banking initiative. USAA was the first bank that we’re aware of to deploy remote deposit capture to consumers in any meaningful scale. With three years under its belt, USAA now supports well over 150 thousand active users on its Deposit@Home product. For perspective, this is more than ten times the number of RDC clients of any other US bank. Now, it’s at it again – this time, enabling mobile banking users to deposit checks using suitably equipped mobile phones. Scoffers are quick to point out that USAA is an anomaly. Indeed it is. USAA Federal Savings Bank serves 5+ million members – all from a single branch in San Antonio. Well, not exactly. The bank happens to have a single branch in San Antonio. Obviously then, USAA cannot rely on its branch network as many banks do to serve its customer base. With assets of $35b (March 2009) and nearly triple the industry average deposit growth over the past three years, USAA appears to be doing just fine without an expensive branch infrastructure. Its transaction mix is rather unlike most banks. Already, USAA has over 1 million mobile banking users, and the service is barely eighteen months old. USAA’s ambition with its mobile banking and mobile deposit service is simple- to make it convenient for its members to bank with USAA whenever and however they wish. Hmmm, that sentiment sounds remarkably similar to that offered by a large number of what we might call traditional retail banks also investing in self-service delivery channels. Observing USAA’s initiative begs the question; will mobile remote deposit capture become broadly adopted by retail banks just as internet and mobile banking has? Mobile RDC is both a great concept and an operationally sound approach – at least the Mitek powered solution is. It represents a powerful way to migrate significant transaction volume from branches to a low-cost self-service channel. In our research, Celent found that nearly 90% of teller transactions involve checks, and a full third are simple check deposits. Why not empower consumers to deposit checks themselves at a fraction of the cost of teller transactions?