Don’t believe the hype but believe blockchain has practical purpose.

The torrential hype surrounding the speculative side of blockchain has been eclipsing the practical initiatives to leverage blockchain technology to improve banking. Over the past decade, banking and payment systems have not kept up with the pace of advancements in the digital economy and information-sharing. Today, the dichotomies are unsustainable between e-commerce platforms and banking and payment systems and electronic trading and post-trade clearing and settlement. In addition, the persistently high cost of remittances needs to be eliminated. Crypto technology, that is, blockchain, smart contracts, and digital assets, is showing promise to align the performance of banking/ payments systems with those of the digital economy.

In Mapping the Crypto Galaxy Part 1: Transaction Banking and Payments, Celent examines the use of crypto technology to build improved rails for retail and wholesale payments. These innovative new rails are delivering strong value propositions across payments messaging, clearing, and settlement and equally important, liquidity management.

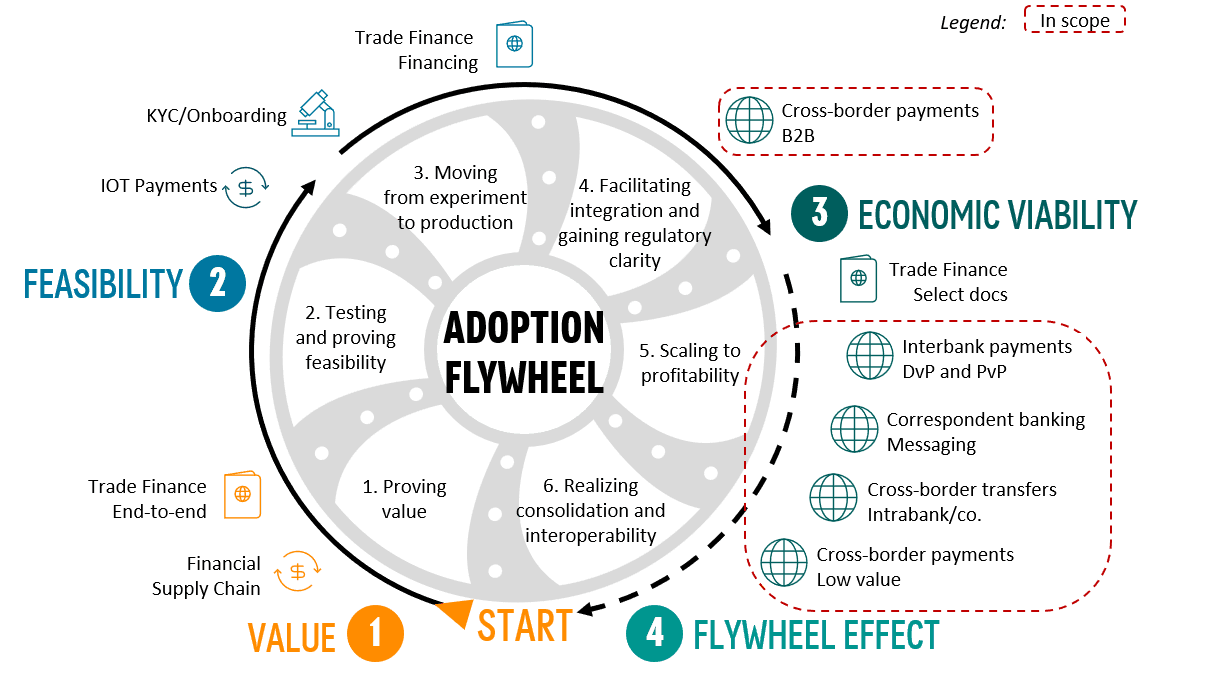

Celent throws the spotlight on eleven “cryptonauts,” that is, vanguard players in the crypto galaxy focused on transaction banking and payments. Most of the cryptonauts have successfully made the journey from the relatively peaceful galaxy of proofs of concept and pilots to the messy galaxy of production. In production, they have been striving to navigate around the meteorites of system integration and paradigm shifts as well as to meet regulatory requirements. Currently, they face the challenge of achieving economic viability, that is, scaling.

These cryptonauts are undertaking literally the heavy lifting to get the adoption flywheel spinning.

Figure 1: The Transaction Banking and Payments Use Case Adoption Flywheel

Cryptonauts included in the report: Adhara, ConsenSys, Fnality, J.P. Morgan, M10, Quartz, R3, Ripple, Stellar, Velo, and Visa.