San Francisco, CA, USA June 9, 2008

Great Expectations: Can SOA Deliver? Part II: Core-Driven SOA (US)

SOA is both an overused buzzword, and a real solution to banking problems. Celent demystifies SOA, explaining what it is, how it helps banks, and how banks can deploy SOA.

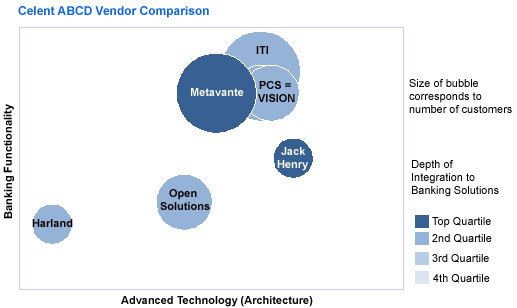

In a new report, Great Expectations: Can SOA Deliver? Part II: Core-Driven SOA (US), Celent explains the various parts of SOA and how it applies to banking. There is a great deal of ambiguity around SOA. It is both a buzzword and a real architecture designed to help banks abstract and expose their core systems. Celent defines SOA to be a set of loosely coupled modular services to support both business and IT requirements. In attempting to clarify what SOA is and how the pieces work together, Celent has created a map of SOA and charted how various non-US core vendors provide solutions to this map. Celent then ranks these vendors on its ABCD analysis.

According to Bart Narter, Celent senior analyst and author of the report, "Core banking vendors are using a service layer to both expose their core system to the expanding number of front end solutions and enable the orchestration of various back end services to create new products and processes for their clients."

The 80-page report contains 46 figures and 67 tables. A table of contents is available online.

Members of Celent's Wholesale Banking and Retail Banking research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.