Buy side front office technology is transforming and consolidating to give asset managers an edge.

In a period of massive technology changes, the last mile of trading is in play. The buy side is investing in multi asset trading technology to ensure they are optimizing their trading.

We are in a period of consolidation of trading technology software and services to create a full suite of front to back offerings for buy side firm. This trend has concentrated traditional portfolio, order, and trading systems into a few places. At the same time, buy side firms are innovating their cross asset trading with new trading technology tools. By and large buy side firms want a hosted multi asset system for their order management and execution needs.

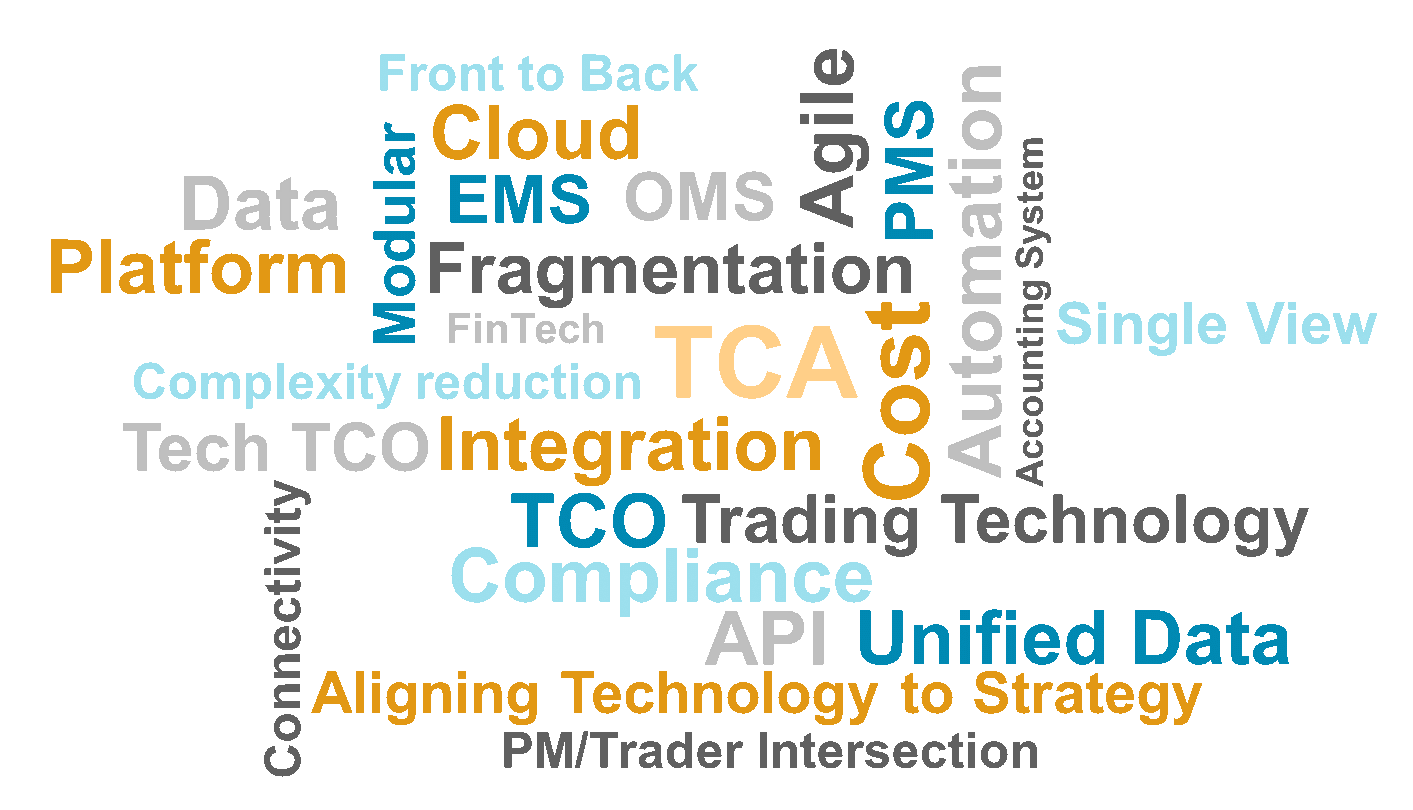

The Word Cloud below highlights top of mind for buy side trading technology decision makers: