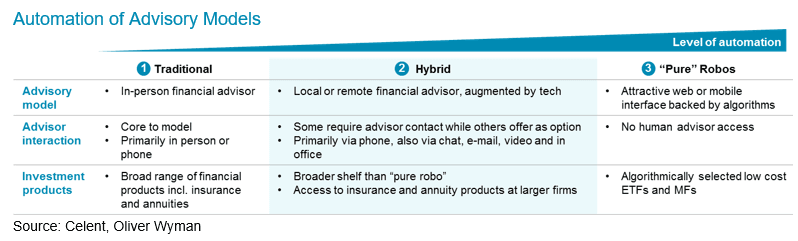

The evolution of hybrid digital advice from a segmentation play (“Call me when you’ve got a million, Mr. Client”) to a more seamless “co-pilot” model has implications for the client proposition and for technology investment generally. What opportunities does the emergence of truly hybridized advice present for vendors and wealth management incumbents alike?