As I write this blog, there are multiple large, mostly uncontained fires burning in the greater Los Angeles area.

So, this blog begins with an expression of compassion for lives lost, injured first responders and residents, and the devastating losses of homes and possessions.

After the fires are extinguished and the number of deaths, injuries and property losses are known with some certainty, there will be a great deal of discussion and analysis concerning why this catastrophe occurred and how to prevent or mitigate its future occurrence.

The goal of this blog is necessarily more modest: to provide a preliminary, insurance analyst perspective on potential steps to minimize the harm of the fire(s) next time. (This blog will necessarily also touch on some broader political, legal, and social issues – but it will try to avoid taking sides since these are “out of scope” for an insurance analyst.)

Loss Control

As insurers increasingly insure connected things (vehicles, buildings, and people); the topic of loss control is becoming central to the future of the industry. Insurance policies cover a specified number of vehicles, buildings. But a wildfire can consume dozens, hundreds or thousands of insured structures. The two critical components of loss control –loss prevention and loss mitigation – will gain in importance.

Prevention of wildfire losses include:

- Something as simple as incentivizing defensible space around structures

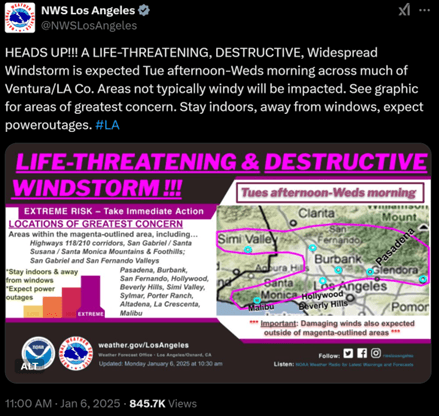

- Something as complicated as anticipatory shutdowns of power lines

Mitigation of wildfire losses include:

- Well publicized and workable evacuation plans and routes

- Having adequate working firefighting resources: people, equipment and water

Pricing Properly

A detailed history of personal lines pricing regulation in California is out of scope for a blog. Suffice it to say that personal lines pricing in California has been based on a ballet referendum, Proposition 103, passed in 1988. In recent years, various restrictions in personal lines insurers’ rate filings and subsequent poor underwriting results have led to a number of major insurers limiting new business and, in some cases, not renewing existing policies. These insurers include such market leaders as Allstate, State Farm, and Farmers.

Reacting to this lack of market capacity in certain geographies, the California Department of Insurance has taken steps to liberalize certain prior restrictions (announcing a new “Sustainable Insurance Strategy”). The major change so far is that the DOI is now allowing rate filings to incorporate catastrophe models and to recognize the cost of reinsurance.

These changes will most benefit insurers with modern pricing modeling software. This category of software has evolved rapidly in recent years, giving actuaries better tools and modeling environments, and improved ways of working with their underwriting and product management colleagues. For more detail, see the recent Celent report “It’s Not Your Grandfather’s Actuary’s Pricing Modeling Solution.”

Also, on January 2 this year, Verisk announced that it has asked the California DOI to review its view of its wildfire catastrophe model, which on acceptance by the department, could be used by insurers who can now incorporate cat models in their filings.

The California FAIR Plan

The FAIR plan is California’s property insurer of last resort. It is a fire insurance pool containing all licensed insurers writing property coverages. Each member insurers shares in the pool’s profits, losses, and expenses proportionately to its California property market share.

So far, so good . . . however . . .

In March 2024, the FAIR Plan President told a California Legislative Committee that it did not “have a lot of money sitting around.” Furthermore, in a major event the FAIR Plan will have to make assessments on property insurers still writing in the state.

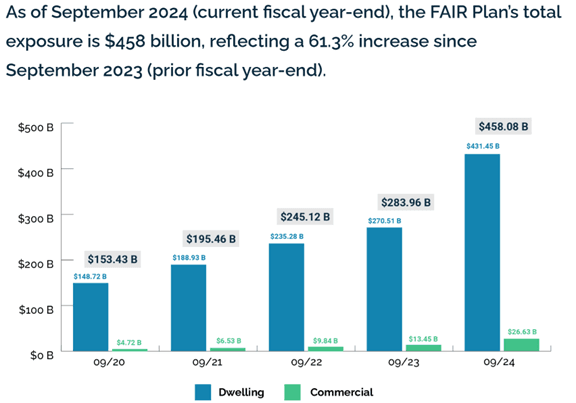

This blogger has been unable to identify any audited financial statements by the FAIR Plan. The plan does provide some information that indicates it has been growing very rapidly in recent year (presumably due to insurers reducing their market presence).

Source: https://www.cfpnet.com/key-statistics-data/

A modest recommendation: the FAIR Plan should be required to make the same public statutory reports as licensed insurers. Without such information, state government, FAIR member insurers, and its policyholders are flying blind.

Conclusion

If anything good is to result from the personal and financial tragedy that is the 2025 Los Angeles fires, both the public and private sector should focus on better loss control, pricing properly, and putting the FAIR plan on a sound actuarial foundation.