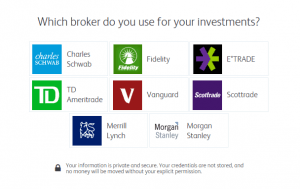

Free advice is poor bait. Just ask SigFig and FutureAdvisor, who rolled out free portfolio analysis tools as a way to hook what proved to be very elusive fish. Indeed, the high cost of retail customer acquisition convinced these B2C robo advisors to embrace B2B (and BlackRock, in the case of FutureAdvisor). Wealthfront, which remains committed to the B2C model, unveiled its own portfolio analysis tool last week. The objective is to wear the white hat as much as to haul in assets. Spokeswoman Kate Wauck describes the introduction of Portfolio Review as “another milestone in our history of delivering services that actually benefit the investor.” The implication, of course, is that the rest of the industry falls short. According to Wealthfront, 92% of the portfolios it reviewed in setting up its Portfolio Review tool were hamstrung by some combination of high fees, cash drag and insufficient diversification. I decided to put my own personal portfolio of roughly a dozen low cost ETFs to the test. It was easy enough. After selecting my brokerage firm (see image at top of post) and logging on via the Wealthfront portal… I’ll share the results in my next post. In the meantime, a couple observations on strategy:

Free advice is poor bait. Just ask SigFig and FutureAdvisor, who rolled out free portfolio analysis tools as a way to hook what proved to be very elusive fish. Indeed, the high cost of retail customer acquisition convinced these B2C robo advisors to embrace B2B (and BlackRock, in the case of FutureAdvisor). Wealthfront, which remains committed to the B2C model, unveiled its own portfolio analysis tool last week. The objective is to wear the white hat as much as to haul in assets. Spokeswoman Kate Wauck describes the introduction of Portfolio Review as “another milestone in our history of delivering services that actually benefit the investor.” The implication, of course, is that the rest of the industry falls short. According to Wealthfront, 92% of the portfolios it reviewed in setting up its Portfolio Review tool were hamstrung by some combination of high fees, cash drag and insufficient diversification. I decided to put my own personal portfolio of roughly a dozen low cost ETFs to the test. It was easy enough. After selecting my brokerage firm (see image at top of post) and logging on via the Wealthfront portal… I’ll share the results in my next post. In the meantime, a couple observations on strategy:

- Wealthfront, which (unlike FutureAdvisor and other robos using aggregation tools) makes allocation recommendations solely based on assets in house, is pulling off the blinders. Peering into competitor platforms and showing why they don’t work suggests a shift in thinking and a renewed assertiveness from idol smasher Adam Nash.

- Here we see the power of proprietary data. While clients were comfortably sleeping, Wealthfront algorithms were crunching portfolio performance numbers. Although a touch presumptuous (by opening an account, did I give Wealthfront permission to review my investing history?), Portfolio Review serves as a nice demo of software engineering, as well as a freebie for the investor.