Intelligent automation projects are worth exploring as they can directly decrease the cost of operations while improving scalability and reducing risk. With mundane operational tasks performed by a bot, a firm’s workforce is supported in a manner that improves not only internal operations but also operations that directly tie into the client experience.

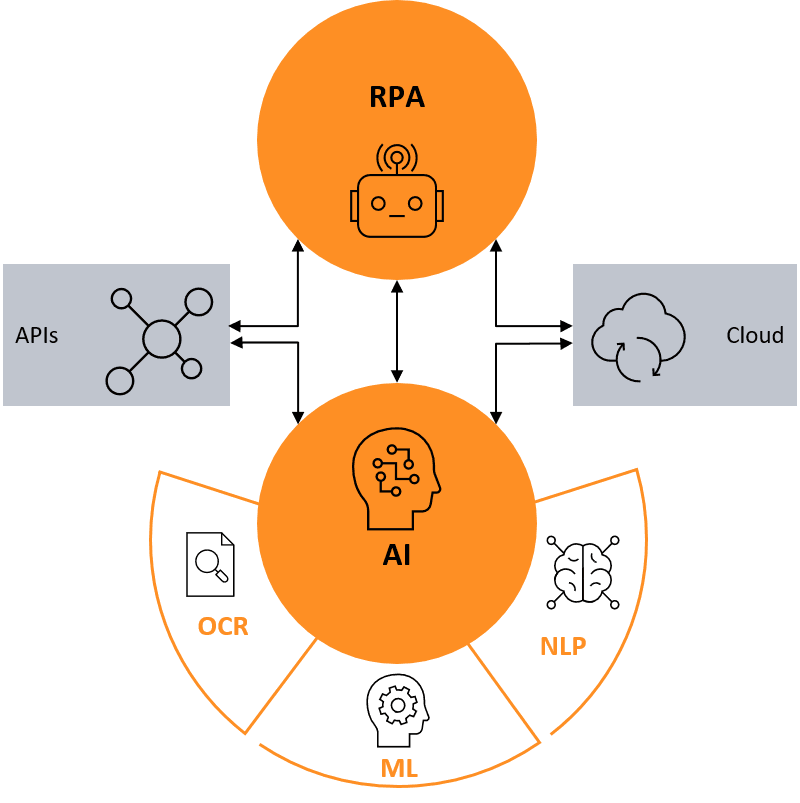

Intelligent automation, in the context of this report, can be described as the combination of robotic process automation (RPA) and artificial intelligence (AI) to automate processes within a workflow.

When reviewing RPA projects, the expected implementation and maintenance costs and bot utilization rates were not typically met, leading a firm to underdeliver on the sought-out benefits (e.g., ROI) of the planned automation. As discussed in Celent’s report RPA in Wealth Management: Promise and Peril, initial RPA projects help with a firm’s understanding of the benefits and application of automation technology and build a firm’s in-house muscle for future, more cognitive RPA solutions, such as intelligent automation enabled by AI. This report explores how the combination of RPA and AI can improve operational efficiency and can deliver customized automation tailored to a firm’s unique workflows.