リスクおよびコンプライアンス業務においては多数のタスクがあり、それらのタスクはロボティクスを利用して自動化することができる。しかし初期のロボティクス導入事例は期待された結果を出していない。その原因は、テクノロジーとしてのRPAではなく、良いガバナンスと事前計画の欠如にある。

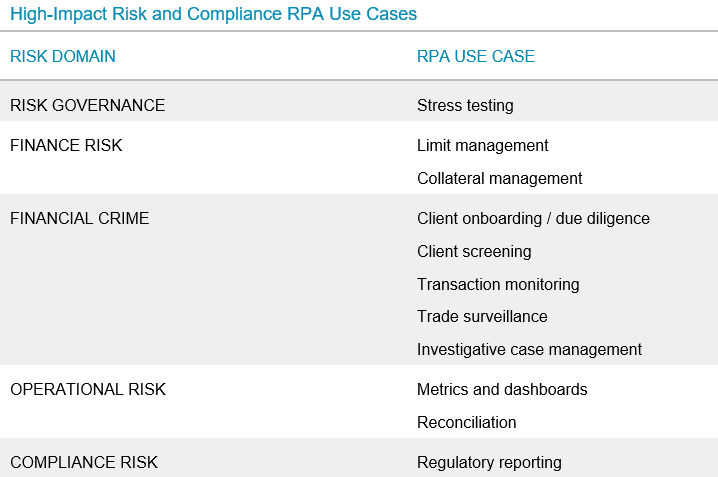

一般的な銀行員は、100件当たり10から30のミスをする。12,000人の不正行為のアナリストおよび60,000人のアンチマネーロンダリング(AML) / コンプライアンスのアナリストを雇っている米国に本拠を置くグローバルな大手金融機関について考察してみよう。その計算結果は衝撃的だ。RPAは、現在は人の関与を必要とするタスクの自動化を可能とする一連のテクノロジーであり、人材配置、リスク軽減、およびコンプライアンス管理のような課題に対処する強力な手法である。