Banking as a Service holds great promise for providing community-based financial institutions with a migration path to becoming fully digital financial institutions.

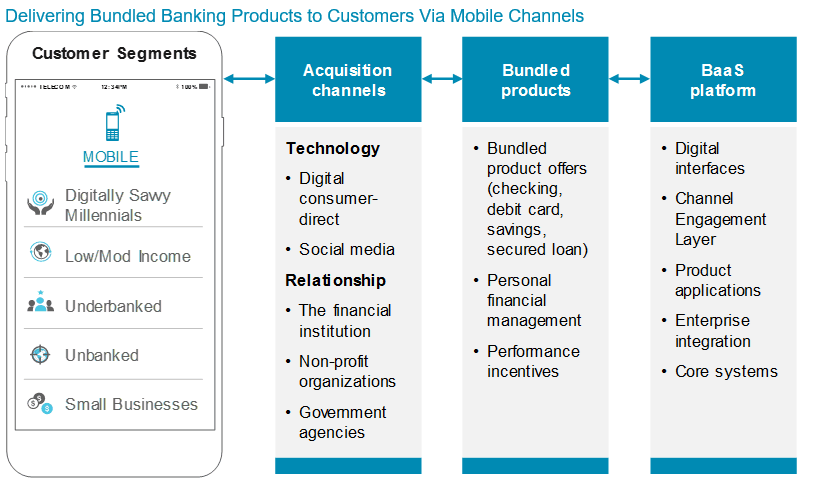

This report assesses the expanding ecosystem of banking business models and IT service delivery models. It then focuses on banking as a service (BaaS), a technology architecture and service delivery model for community-based financial institutions, Big Tech firms, and retailers seeking to offer digital banking services.

The report focuses on:

- The market, business and technology drivers of digital banking in the cloud.

- The current and future evolution of banking business models and IT platforms.

- A detailed examination of BaaS.

- The competitive impact of new banking models on financial institutions.

- The long-term impact on banking and technology markets.