The good news is that these vendors go to market with comprehensive solutions covering all the components. The bad news is that only a couple of vendors have their systems already in production in at least one line of business in the region.

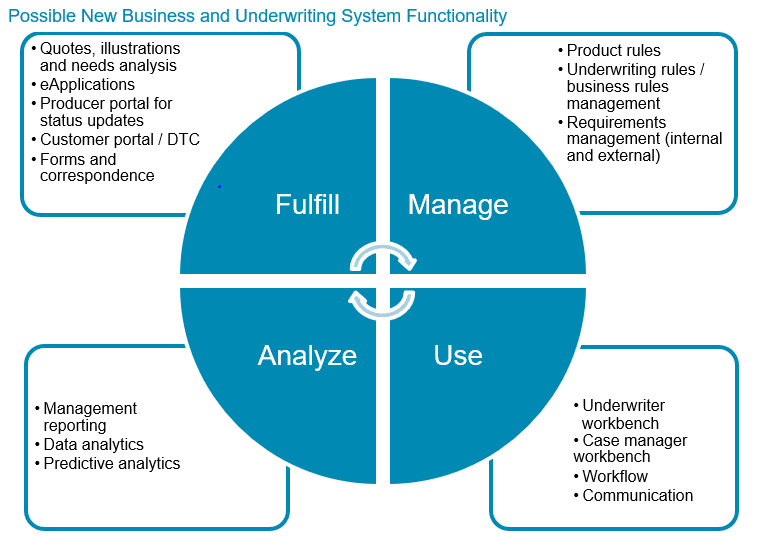

Automating the new business and underwriting functions are critical components in reaching a level of straight-through processing (STP) for new business. Insurers hope that these systems will help reduce unit costs and improve margins. Celent believes that these initiatives are necessary to help the insurers address growth, service, and distribution mandates and reduce the cost per policy issued.

This report profiles new business and automated underwriting (NBUW) systems available to life insurers in Latin America (LATAM). This report profiles nine systems in use or being marketed for Latin America life, health, and annuities products. Later in 2018, Celent will publish two reports on best practices and benchmarking in new business and underwriting. Together with this report, the reader will have a strong understanding of what is being done and available for the new business function.

This report should help insurers as they refine their new business and underwriting technology strategies and, where appropriate, create a list of vendors for evaluation.