Tokyo, Japan May 27, 2008

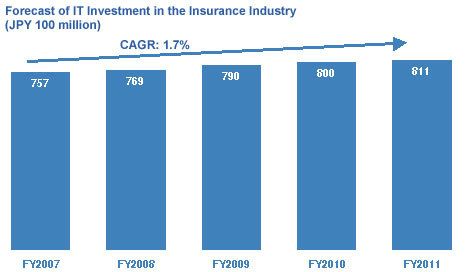

IT investment in Japan's insurance sector is expected to reach JPY 757 billion by March 2008, and JPY 811 billion by March 2012, for a compound annual growth rate of 1.7%. 2012 will be a turning point in IT investment growth, after which a gradual slowdown will occur until spending reaches a steady level.

Japan's insurance market has become increasingly competitive over the past decade through the introduction of structural reforms as well as the infusion of foreign capital. The market has also undergone significant structural changes characterized by the emergence of Internet-based insurance sales and the introduction of third sector products in addition to conventional modes of life and non-life insurance.According to a new report, , Japan's insurance market looks set to move ahead with the digitization of paper-based information, automation of payment processing, and adoption of workflow tools and content management systems in tandem with revisions of claim and policy administration systems.

Insurance companies have invested heavily in numerous products that support market demands, but have not effectively supported them. Carriers face barriers such as consolidating product lines, creating a strategic approach to wealth management, and complying with J-SOX.

"Both life and non-life insurers are now at the stage where they are revising their future business model strategies. With the melee of the third sector due to life and non-life products flooding the market, insurers must provide customers with the right information and responses in order to remain viable," says Yumiko Manchu, an analyst at Celent and author of the report.

"The recent deregulation of over-the-counter bancassurance presents insurance companies with a powerful sales channel, one which will likely see healthy investment in technology as a result of the need for adequate support in order to realize long-term business opportunities."

This report examines the business environment surrounding the domestic insurance industry in Japan. It looks at IT spending areas in the insurance industry and forecasts future trends.

The 25-page report contains 16 figures and 2 tables. A table of contents is available online.

Members of Celent's Life/Health Insurance and Property/Casualty Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.