The unrelenting data breaches have a silver lining, offering banks an opportunity to reinvent the customer experience.

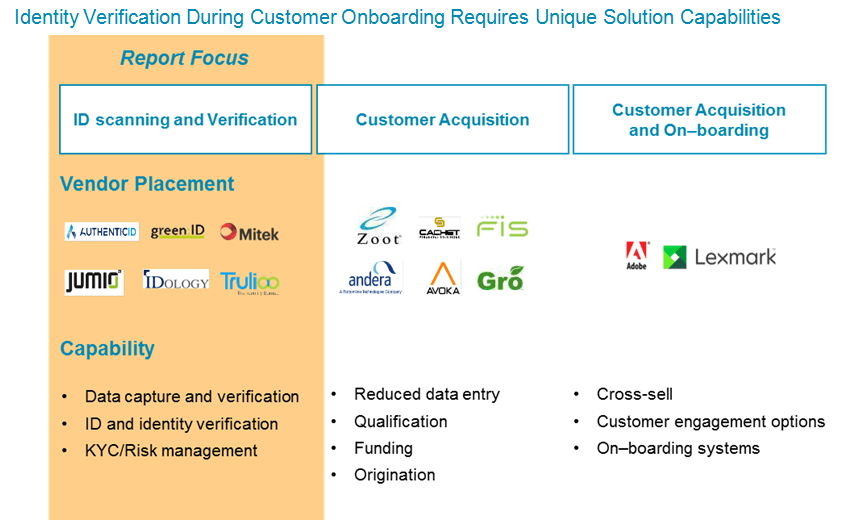

Digital customer acquisition and onboarding is becoming increasingly important to financial institutions in response to changing consumer preferences. Historically, digital onboarding presented a two-fold challenge; achieving adequate risk and compliance objectives while ensuring a low-friction customer experience (CX). This was particularly difficult for the mobile use case because of the small screen size and difficulty associated with manual data entry. Recent hardware and software advancements, however, have turned what was once a mobile liability into a strength. Finding the right solution can be difficult. Celent offers a no-nonsense comparison of leading solutions and considerations for choosing the best way forward for your bank.