Over the past 20 months, financial institutions have been faced with challenges across every aspect of risk management and compliance. In financial risk, economic headwinds and volatility created rapid bust and boom cycles and gyrating balance sheets. Workforce issues as well as the volatility brought on by the pandemic challenged firms’ basic operational resiliency and the ability to forecast future scenarios. Unprecedented levels of money laundering and fraud have exploited a vulnerable population and chinks in the armor of financial crime and cybersecurity operations.

These and other emerging challenges are requiring financial institutions to step up use of digital technologies, AI, and alternative data to monitor financial and operational risks and update scenarios in real time in order to deal with fast-moving events in a volatile world. Compliance operations are adopting AI, software robotics, and other digital tools and data in order to drive much-needed increases in the efficiency and efficacy of financial crime operations. A rapidly developing ecosystem of agile, cloud-native regtech solutions as well as investments in next-gen capabilities by incumbent technology providers will support the digitization and automation of financial crime operations.

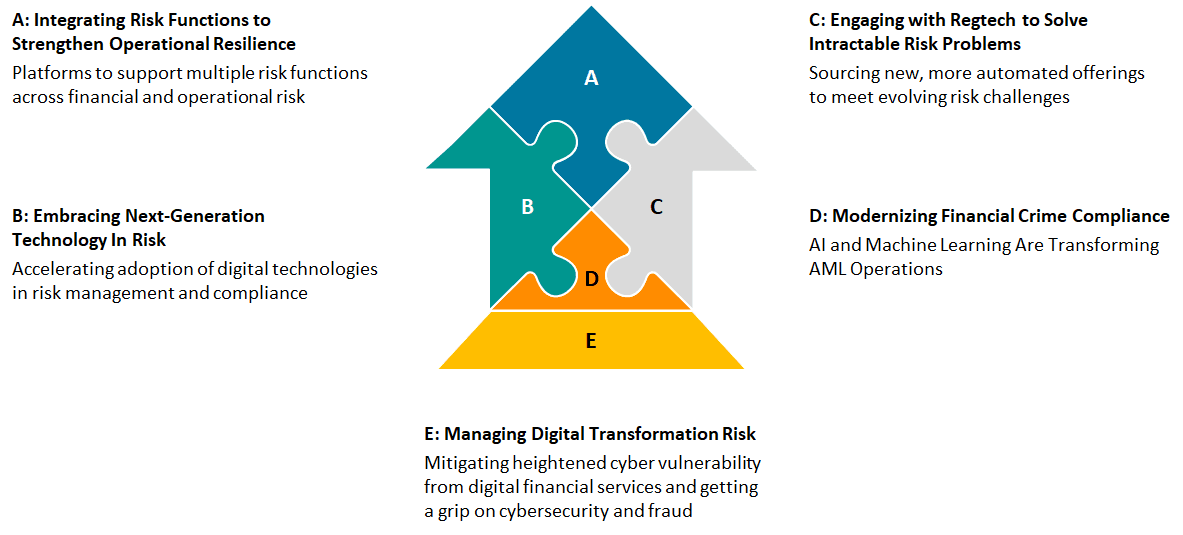

This report summarizes Celent’s guidance to clients around five key themes in risk for 2022. The report is part of Celent's new Previsory (Pre-view and ad-visory) series, a forward-looking view of financial technology trends across our industry verticals and advice on how to respond to them.

Key Technology Trends and Imperatives for Risk in 2022