Public cloud adoption has been growing steadily in many industries. Financial institution (FI) cloud adoption has been slower, though, because these firms are heavily regulated due to the large amount of confidential financial customer information they possess. FI information security; risk and compliance; and ecosystem management, integration, and control preferences are exceedingly high. As a result, many banking applications in the public cloud today are not mission critical or do not directly expose core systems and databases.

As cloud computing grows from being a small part of a financial institution’s computing environment to becoming the dominant computing paradigm, its impact on the entire firm increases. Structural changes to line of business processes, personnel requirements, and technology will require stakeholders to rethink how they deliver value through technology.

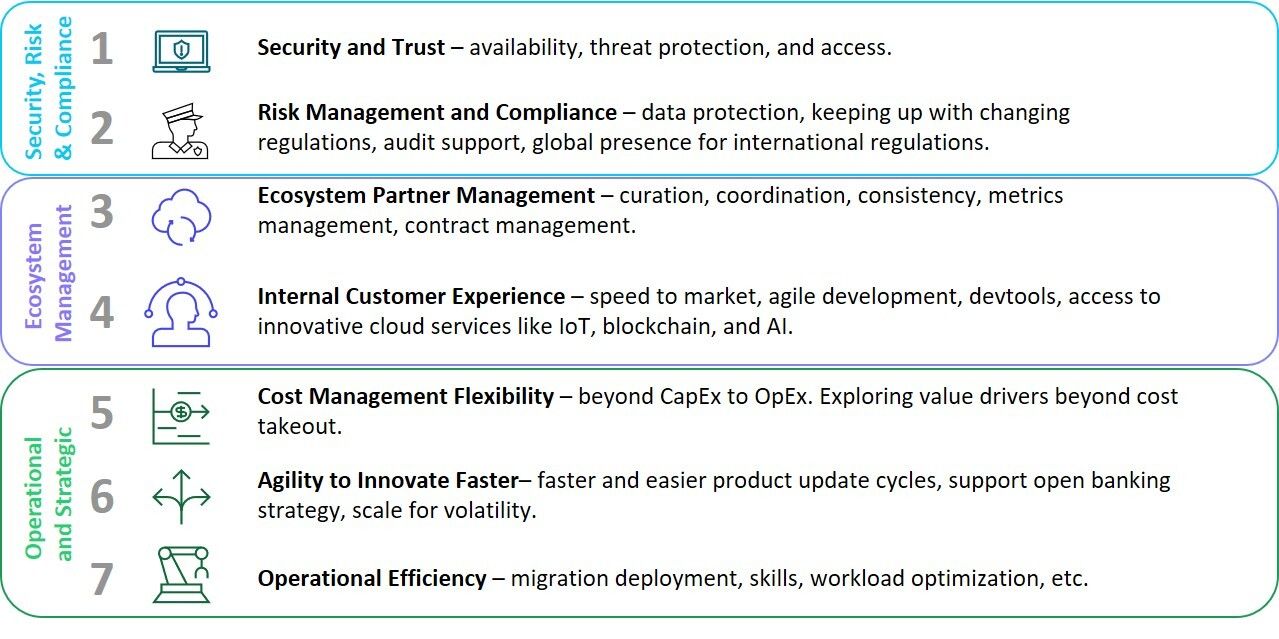

To address this evolving strategic transition, Celent has identified seven key considerations for CIOs, CISOs, CROs, and line of business stakeholders. The figure below outlines these considerations across three broad categories: security, risk and compliance; ecosystem management; and current operations and strategic planning.

The path to cloud has many routes, with some financial institutions slowly dipping in with specific non-critical applications, while others enact sweeping cloud migration strategies across the entire application ecosystem. No matter the path, there are considerations that will affect the success of the journey. The business case is clear, and banks should use this report as a starting point to address questions that will ultimately maximize the success of migration efforts to the public cloud.