The securities industry has experienced a great upheaval since the Great Financial Crisis over a decade ago. Changes to regulation, market structure, business models and technology have driven the financial industry to embark on a massive transformation of industry processing models. While the pace of general technology innovation is accelerating, the pace of change in technology supporting those models is steadier—perhaps even seeming slow from certain vantage points.

The sudden shift to working from home acted as an accelerant to cloud adoption efforts across capital markets, but legacy applications and architectures can remain difficult to modernize. This has played out against a backdrop where the value of data is rising—but only for those with the technology and capabilities to exploit this.

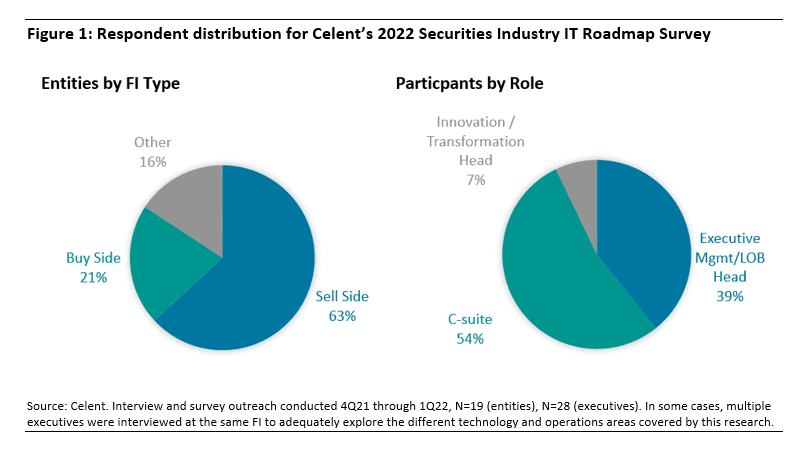

To help understand how its clients are preparing for this cloud-enabled, data-driven world, DTCC commissioned Celent to conduct extensive research over the end of 2021 and early 2022, into technology adoption and future plans of select clients. DTCC’s clients play a critical role in reimagining and building the financial marketplaces of the future and so are uniquely placed to share views on the evolution of technology across the securities industry.

The study was conducted in the forma of analyst-led interviews, and data collection via survey. We spoke with 28 technology and operations senior executive leaders across 19 North American finanical instittutions. This extensive outreach was supplemented with Celent’s proprietary research and expertise to build a picture of the current and future state of the securities industry’s information technology across the four focus areas. This report discusses how adoption and plans to leverage new technologies are often balanced against the reality of needing to maintain legacy approaches due to both technology and business drivers, including the readiness of a firm’s own clients to adapt to change.

Key findings include:

- Cloud adoption is nearly universal albeit to varying degrees; AWS and MS Azure aere clear leaders in terms of marktet share and primary provider status, respectively.

- Nearly 50% of all study participants can be categorized as “Cloud Leaders

- The top three drivers for cloud adoptionincreasing business agility, increasing operational efficiency, and improving security and resilience.

- Most study participants took a federated approach to cloud adoption,

- Mainframe continues to support firms’ core processing and is not likely to disappear.

- Full migration to modern methods of data exchange is effectively gridlocked.

- Data exchange remains stubbornly mired in manual and batch-based approaches, but data marketplaces, DLT, and APIs are expected to dominate in the next two years.

- Building a business case for true transformation will requirecross-industry coordination.

- Most firms consider themselves relatively immature in the use of artificial intelligence and machine learning (AI/ML)

- Currently, AI/ML development is allocated a small portion of enterprise technology budget (1–5%).

Who Should Read This Report?

The report shares primary and secondary research on the prevailing views and strategies related to technology adoption by financial institutions operating in capital markets (securities firms and investment managers) across the US and Canada. The focus is on cloud, mainframe modernization, and data topics such as data exchange mechanisms/data management and AI/ML. The report addresses the needs of:

- CIOs: Chief Information Officers and senior staff responsible for long-term technology strategy, vision, development, and maintenance.

- CISOs: Chief Information Security Officers responsible for assessing IT risks and other security risks that impact the business.

- CROs: Chief Risk Officers responsible for compliance, operational, financial, asset, and other forms of risk.

- LOBs Heads: Line of Business Heads responsible for revenue generation and key securities support functions such as Operations.

Study Participants