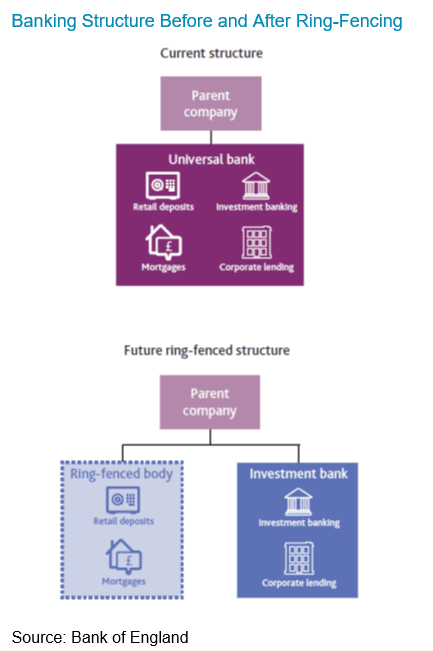

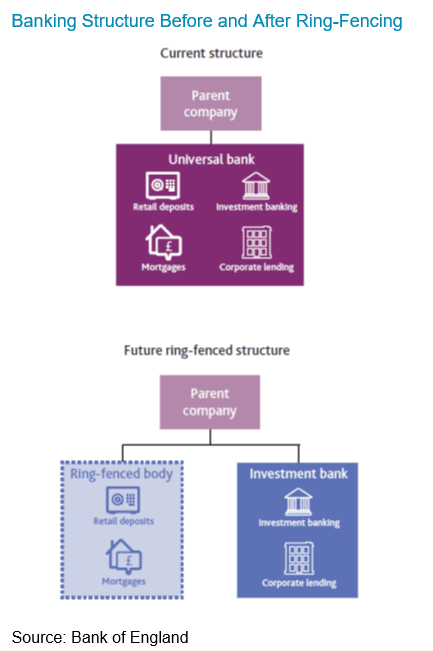

「リングフェンス」または「構造改革」は、銀行のリテール銀行業務を銀行のホールセール/投資銀行業務から切り離すことを義務付ける規制のことを指している。二つの部門を切り離すために、銀行は独自のオペレーションITおよびデータ管理システムを持たなければならない。

「リングフェンス」または「構造改革」は、銀行のリテール銀行業務を銀行のホールセール/投資銀行業務から切り離すことを義務付ける規制のことを指している。二つの部門を切り離すために、銀行は独自のオペレーションITおよびデータ管理システムを持たなければならない。